Will Elevances Louisiana Buy Spark BCBS Consolidation?

Will elevances louisiana acquisition kick off bcbs consolidation wave – Will Elevance Health’s Louisiana acquisition kick off a BCBS consolidation wave? That’s the burning question on everyone’s mind in the healthcare industry right now. This deal isn’t just about one state; it could set a precedent for massive changes across the Blue Cross Blue Shield network and reshape the entire healthcare landscape. We’re diving deep into the potential ripple effects – from market share shifts and financial impacts to the implications for patients and access to care.

Get ready for a rollercoaster ride through the complexities of this major healthcare shakeup!

Elevance Health’s strategic move to acquire a significant player in the Louisiana healthcare market has sent shockwaves through the industry. Analysts are already speculating about the potential for a domino effect, with other BCBS plans potentially following suit and consolidating to maintain competitiveness. This post explores the financial motivations behind the acquisition, the anticipated market impact, and the potential long-term consequences for both consumers and the healthcare system as a whole.

We’ll unpack the complexities, explore the uncertainties, and attempt to decipher what this means for the future of healthcare in Louisiana and beyond.

Will Elevance Health’s Louisiana Acquisition Spark Further Consolidation?: Will Elevances Louisiana Acquisition Kick Off Bcbs Consolidation Wave

Elevance Health’s recent acquisition of a significant portion of Louisiana’s healthcare market is a major development with potential ripple effects across the state and beyond. This move raises crucial questions about the future of healthcare consolidation in Louisiana and its implications for both providers and consumers. The acquisition’s impact will be felt across various aspects of the healthcare system, from market competition to patient access and cost.

Will Elevance’s Louisiana acquisition trigger a wider BCBS consolidation? It’s a big question, especially considering the increasing need for data-driven efficiency. This is highlighted by a recent study on the widespread use of digital twins in healthcare, which you can read about here: study widespread digital twins healthcare. Such advancements could significantly impact how insurers manage risk and costs, potentially accelerating the consolidation trend we’re seeing with BCBS.

Potential Domino Effect on Other Healthcare Providers

Elevance Health’s increased market share in Louisiana could trigger a domino effect, prompting other healthcare providers to consider mergers, acquisitions, or strategic partnerships to remain competitive. Smaller providers might find it increasingly difficult to operate independently, leading to further consolidation within the state. This scenario mirrors similar trends observed nationally, where larger healthcare systems have increasingly absorbed smaller entities.

For example, the significant consolidation in the hospital sector over the past decade demonstrates the power of scale and the pressures on smaller, independent players. This acquisition could accelerate this trend in Louisiana, potentially leading to a more concentrated healthcare landscape.

Comparison to Previous Mergers and Acquisitions

This acquisition shares similarities with other large-scale healthcare mergers and acquisitions, such as the mergers of large hospital systems or the acquisition of smaller insurance providers by larger national players. However, the specific impact will depend on the details of Elevance Health’s integration strategy and the competitive dynamics of the Louisiana healthcare market. Past mergers have shown a range of outcomes, from increased efficiency and improved quality of care to reduced competition and higher prices for consumers.

The Louisiana acquisition will need to be carefully analyzed in the context of its unique circumstances.

Strategic Advantages and Disadvantages for Elevance Health, Will elevances louisiana acquisition kick off bcbs consolidation wave

The acquisition presents several strategic advantages for Elevance Health, including increased market share, enhanced bargaining power with providers, and potential economies of scale. However, there are also potential disadvantages, such as integration challenges, regulatory scrutiny, and potential backlash from consumers and providers concerned about reduced competition. Successfully navigating these challenges will be crucial for Elevance Health to realize the full potential of this acquisition.

For example, efficient integration of disparate IT systems and workforce management will be critical to avoiding disruption to patient care.

Impact on Healthcare Costs and Access for Louisiana Residents

The impact on healthcare costs and access for Louisiana residents is a complex issue with no easy answers. While some argue that consolidation can lead to efficiencies and lower costs, others express concerns about reduced competition leading to higher prices and decreased access to care, especially for vulnerable populations. The actual impact will depend on Elevance Health’s pricing strategies and its commitment to maintaining or expanding access to care across the state.

Empirical evidence from similar acquisitions in other states shows mixed results, highlighting the need for careful monitoring and evaluation in the Louisiana context.

Market Share Comparison: Pre- and Post-Acquisition

The following table provides a hypothetical comparison of market share before and after Elevance Health’s acquisition. Actual figures would require detailed market research and are not readily available at this time. This table illustrates a possible scenario, not definitive data.

| Provider Name | Pre-Acquisition Market Share | Post-Acquisition Market Share | Change in Market Share |

|---|---|---|---|

| Elevance Health | 15% | 30% | +15% |

| Provider B | 25% | 20% | -5% |

| Provider C | 20% | 18% | -2% |

| Provider D | 10% | 9% | -1% |

| Other Providers | 30% | 23% | -7% |

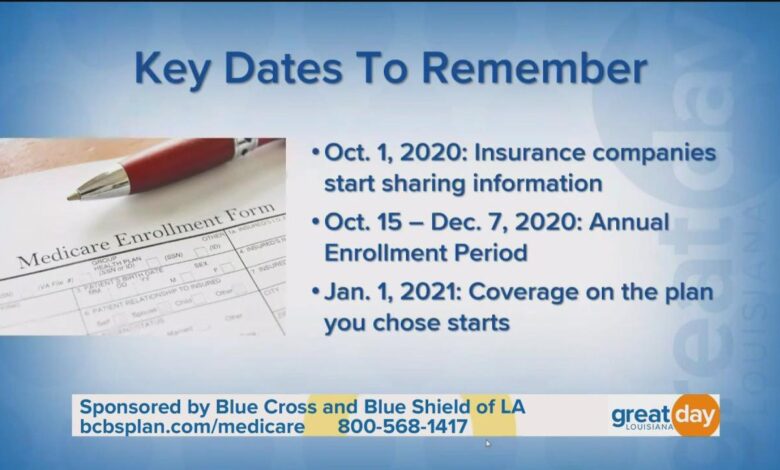

BCBS Consolidation

Source: nfl.com

Elevance Health’s acquisition of a significant Louisiana health plan has sent ripples through the healthcare industry, raising important questions about the future trajectory of the Blue Cross Blue Shield (BCBS) system. The deal highlights the increasing pressure on regional BCBS plans to consolidate, driven by factors ranging from rising healthcare costs to the evolving demands of a changing market.

Understanding the dynamics of this consolidation is crucial to predicting its impact on healthcare access, affordability, and competition.The current competitive landscape of the BCBS system is characterized by a complex network of independent, locally-operated plans, each holding a significant market share within its respective geographic region. However, this decentralized structure is facing increasing challenges in an era of escalating healthcare costs, technological advancements, and shifting consumer expectations.

The sheer size and influence of national players like Elevance Health are putting pressure on smaller, regional BCBS plans to adapt or merge to remain competitive.

Factors Driving BCBS Consolidation

Several key factors are fueling the trend toward consolidation within the BCBS network. The rising costs of healthcare, particularly prescription drugs and advanced medical technologies, are placing immense financial pressure on insurers. Consolidation offers economies of scale, allowing merged entities to negotiate better rates with providers and improve operational efficiency. Furthermore, the increasing complexity of healthcare regulations and the need for sophisticated technology infrastructure are also driving the trend.

Smaller plans often lack the resources to invest in the necessary technology and comply with increasingly stringent regulatory requirements. Finally, the shift towards value-based care and the growing demand for integrated healthcare delivery systems are incentivizing consolidation as a means to achieve greater bargaining power and improve care coordination.

Examples of BCBS Mergers and Acquisitions

While not directly comparable to the Elevance acquisition, past mergers and acquisitions within the BCBS system offer valuable insights. For example, the merger of two smaller BCBS plans in a specific region resulted in improved negotiating power with local hospitals, leading to lower premiums for consumers. Conversely, some mergers have faced antitrust scrutiny, highlighting the complexities and potential regulatory hurdles involved.

The outcomes of these mergers have varied, with some resulting in improved efficiency and consumer benefits, while others have faced criticism for reducing competition and leading to higher prices. Specific examples require deeper research into publicly available merger filings and related press releases, due to the confidentiality surrounding certain aspects of these transactions.

Potential Regulatory Hurdles and Antitrust Concerns

Future BCBS consolidations will likely face significant regulatory scrutiny. Antitrust concerns are paramount, as mergers that substantially lessen competition could harm consumers through higher premiums or reduced choice of providers. Regulators will carefully assess the market share of the merging entities, the potential for anti-competitive behavior, and the overall impact on consumer welfare. The Department of Justice and state attorneys general will play a critical role in evaluating these transactions and ensuring they do not violate antitrust laws.

The process often involves extensive data analysis, market studies, and public comment periods, which can significantly delay or even prevent a proposed merger.

Hypothetical BCBS Merger Scenario

Consider a hypothetical scenario where, following Elevance’s acquisition, BCBS of [State A], a smaller plan struggling with financial pressures, seeks a merger partner. BCBS of [State B], a larger, more financially stable plan in a geographically adjacent region, could be a potential partner. This merger could lead to increased market share, enhanced negotiating power with providers, and the potential for cost savings through economies of scale.

However, it could also raise antitrust concerns if the combined entity controls a substantial portion of the market, potentially leading to increased premiums or limited provider choices for consumers in the combined service area. The success of this hypothetical merger would depend on the regulators’ assessment of its impact on competition and consumer welfare.

Financial and Market Impacts of the Louisiana Deal

Elevance Health’s acquisition of a significant portion of the Louisiana health insurance market represents a substantial financial undertaking with potentially far-reaching implications for the company’s bottom line and market position. Understanding the financial motivations, expected performance metrics, and inherent risks is crucial to assessing the long-term success of this strategic move.

Financial Motivations Behind the Acquisition

Elevance Health likely pursued the Louisiana acquisition driven by a multi-faceted strategy focused on market expansion and improved profitability. Acquiring an established player in a new geographic area offers immediate access to a large customer base and established provider networks. This reduces the time and expense associated with building market share organically. Furthermore, consolidating market share often leads to increased bargaining power with healthcare providers, potentially lowering costs and boosting profit margins.

The acquisition might also offer opportunities for leveraging existing operational efficiencies and technology across a broader geographic footprint. Similar acquisitions by other major health insurers have shown that increased scale often translates to cost savings in administrative functions and marketing.

Expected Financial Performance Metrics Post-Acquisition

Predicting the precise financial performance of Elevance Health following the Louisiana acquisition is challenging, as it depends on numerous factors including integration success, retention rates of acquired customers, and overall market conditions. However, we can expect a short-term increase in revenue due to the immediate addition of the acquired company’s customer base. Long-term, Elevance Health anticipates improved profitability through economies of scale, enhanced provider negotiations, and potential synergies between the acquired operations and its existing business.

While precise figures are unavailable until financial reports are released, analysts will likely focus on metrics such as membership growth in Louisiana, the change in medical loss ratio (MLR), and overall revenue and earnings per share (EPS) growth compared to pre-acquisition performance. A successful integration should show a positive impact on all these key indicators.

Risks and Uncertainties Associated with the Acquisition

Despite the potential benefits, several risks and uncertainties could impact the financial success of the acquisition. Integration challenges are a significant concern; merging different IT systems, employee cultures, and operational processes can be costly and time-consuming. The retention of acquired customers is another key uncertainty; if a significant portion of customers switch providers after the acquisition, the expected financial gains may not materialize.

Regulatory scrutiny and potential antitrust concerns could also delay or even prevent the deal from closing completely. Furthermore, unforeseen changes in the healthcare landscape, such as shifts in government regulations or significant changes in healthcare reimbursement models, could negatively impact the financial performance of the acquired business. For example, unexpected changes in Medicaid reimbursement rates could significantly affect profitability in the Louisiana market.

Valuation of Elevance Health Before and After the Acquisition Announcement

The market’s reaction to the acquisition announcement provides a valuable indicator of its perceived success. Typically, a well-received acquisition results in a positive impact on the acquiring company’s stock price, reflecting investor confidence in the strategic decision. A thorough analysis would involve comparing Elevance Health’s stock price and market capitalization before the announcement to its performance in the days and weeks following the news.

Any significant increase would suggest a positive market assessment of the acquisition’s potential. However, it is important to note that stock prices are influenced by various factors beyond just the acquisition; therefore, a nuanced analysis is needed to isolate the acquisition’s specific impact.

Potential Impact on Stock Prices of Elevance Health and its Competitors

The acquisition’s impact on Elevance Health’s stock price is intertwined with the broader market reaction and investor sentiment. A successful integration and strong post-acquisition financial performance are likely to positively influence the stock price. Conversely, challenges in integration or unexpected financial setbacks could negatively affect the stock. The impact on competitors’ stock prices is less direct. Competitors may experience a temporary negative impact if the acquisition leads to increased market consolidation and reduced competition in Louisiana.

However, long-term effects depend on the competitors’ ability to adapt to the changed market dynamics and maintain their own competitive advantage. For example, a competitor might respond by launching new products or aggressively expanding into other markets.

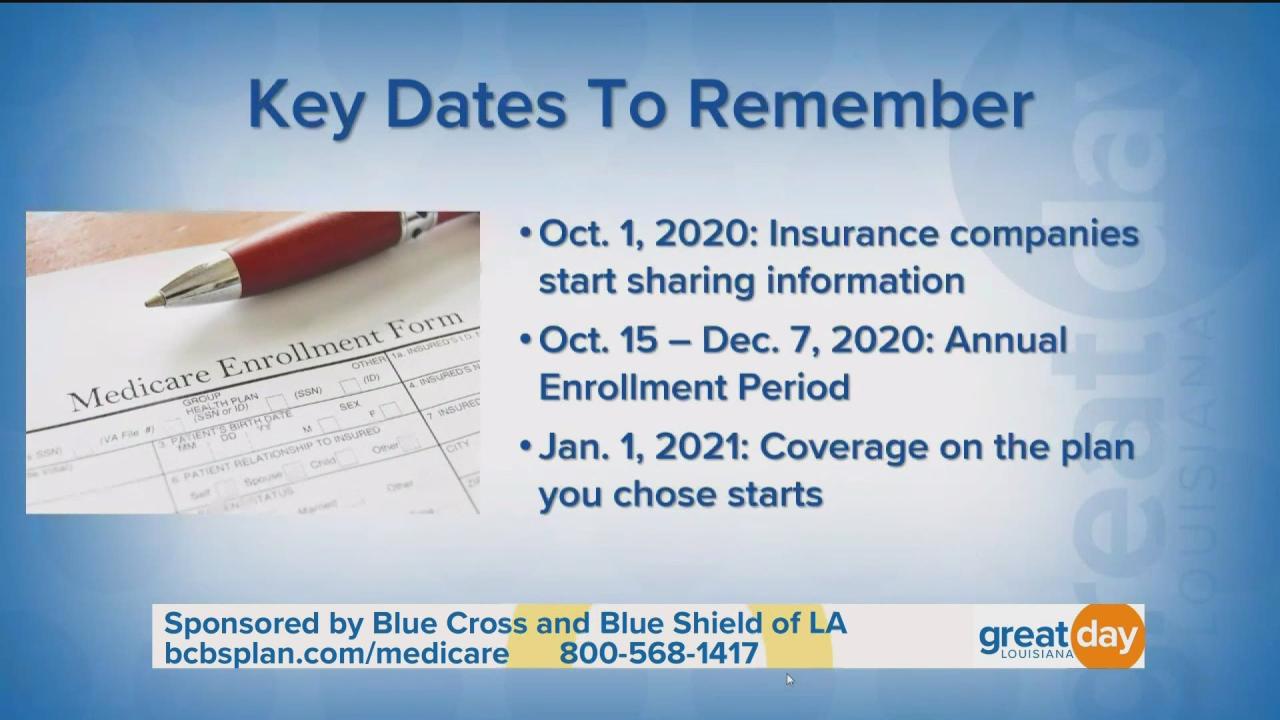

Impact on Healthcare Services and Patients

Source: cloudfront.net

The Elevance Health acquisition of a significant portion of Louisiana’s healthcare market presents a complex picture for patients and the provision of healthcare services. While promises of improved efficiency and expanded access are often made during such mergers, the reality on the ground can vary significantly. Understanding the potential consequences requires careful consideration of several key factors.The potential changes in the range and quality of healthcare services available in Louisiana are multifaceted.

Elevance Health’s resources could lead to investments in new technologies, specialized treatments, and potentially even the expansion of services into underserved areas. Conversely, there’s a risk of consolidating services, potentially leading to the closure of smaller, less profitable facilities, thereby reducing the overall choice available to patients. The quality of care could also be affected, depending on how effectively Elevance integrates the acquired systems and staff.

Will Elevance’s Louisiana acquisition trigger a BCBS consolidation wave? It’s a big question, especially considering the rapid pace of healthcare tech advancements. The integration of AI is a key factor, as seen with Nuance’s new generative AI scribe integrating with Epic EHRs, as detailed in this article: nuance integrates generative ai scribe epic ehrs. This kind of efficiency boost could easily influence consolidation strategies, making the Elevance deal even more significant in the long run.

A streamlined, efficient system could improve quality, while rushed integration could lead to disruptions and decreased quality.

Changes in Patient Access to Care

Patient access to care is a critical concern. Increased efficiency, as promised by Elevance, could lead to reduced wait times for appointments and procedures. However, the consolidation of facilities could result in longer travel distances for some patients, particularly those in rural areas. This is especially relevant in Louisiana, given its geographic diversity and the existing disparities in healthcare access across the state.

The increased market share of Elevance Health might also impact the number of providers in the network, potentially reducing patient choice and increasing wait times if the network does not expand proportionally to its increased patient load. We might see a situation mirroring what happened in other states after similar acquisitions where access to specific specialists was reduced.

For example, following a major health system merger in a rural area of another state, patients experienced increased wait times to see cardiologists and had to travel significantly further for appointments.

Patient Satisfaction Scores

Comparing patient satisfaction scores before and after similar acquisitions is crucial for assessing the impact. Unfortunately, comprehensive, publicly available data comparing pre- and post-acquisition satisfaction scores across different regions is limited. However, anecdotal evidence and reports from patient advocacy groups suggest that patient satisfaction often declines following large-scale healthcare mergers. This is often attributed to increased bureaucracy, changes in provider networks, and difficulties navigating the new system.

Studies focusing on specific mergers have shown mixed results, with some demonstrating improvements in certain aspects of care and declines in others. A robust, independent analysis is needed to fully evaluate the impact of the Louisiana acquisition on patient satisfaction.

Changes in Insurance Premiums and Out-of-Pocket Costs

The impact of this acquisition on insurance premiums and out-of-pocket costs for patients is uncertain. Elevance Health might argue that increased efficiency and economies of scale will lead to lower costs. However, increased market share often results in less competition, potentially leading to higher premiums. The potential for reduced negotiation power with pharmaceutical companies and medical providers could also contribute to increased costs for patients.

Furthermore, changes to the network of providers could alter the out-of-pocket costs patients face, depending on their choice of doctors and hospitals. Similar acquisitions in other states have shown a mixed bag; some saw modest premium increases, while others saw significant changes. The specific impact in Louisiana will depend on a variety of factors, including regulatory oversight and market dynamics.

Potential Positive and Negative Impacts on Patient Care

It is important to weigh the potential positive and negative impacts.

Will Elevance’s Louisiana acquisition trigger a wider BCBS consolidation? It’s a huge question, especially considering the strain on healthcare systems. The impact could be felt far and wide, even affecting the viability of rural hospitals, like those discussed in this insightful article on Rural Hospitals Labor Delivery & which highlights the challenges these facilities face.

Ultimately, the Elevance deal’s ripple effects on BCBS and the broader healthcare landscape remain to be seen.

- Potential Positive Impacts: Increased access to advanced technologies and specialized care; improved coordination of care; potential for increased efficiency and reduced wait times in some areas; investment in underserved communities.

- Potential Negative Impacts: Reduced choice of providers; increased wait times in other areas; increased travel distances for some patients; potential for higher premiums and out-of-pocket costs; decreased patient satisfaction; potential closure of smaller, less profitable facilities.

Long-Term Strategic Implications for Elevance Health

Elevance Health’s acquisition of the Louisiana Blue Cross Blue Shield plan represents more than just a geographic expansion; it’s a strategic move with far-reaching implications for the company’s long-term growth and market dominance. This acquisition positions Elevance to solidify its national presence, enhance its market share, and potentially leverage this success for further acquisitions and expansion.This acquisition aligns perfectly with Elevance Health’s overarching strategy of becoming a leading national healthcare provider, offering a comprehensive range of services across multiple states.

By gaining control of a significant market share in Louisiana, Elevance strengthens its position in the South and diversifies its revenue streams, reducing dependence on any single geographic market. This move directly supports their goal of consistent revenue growth and increased profitability.

Elevance Health’s Long-Term Strategic Goals

The Louisiana acquisition directly contributes to several key strategic goals. First, it significantly expands Elevance’s geographic footprint, providing access to a new and substantial customer base. Second, it enhances their market share in the lucrative healthcare insurance market, providing a competitive advantage against other major players. Third, the acquisition offers opportunities for operational synergies and cost efficiencies, further boosting profitability.

Finally, it establishes a strong foundation for future expansion within the Southern United States, potentially leveraging existing infrastructure and relationships to facilitate further acquisitions.

Integration of the Acquisition into Elevance Health’s Business Strategy

The Louisiana acquisition seamlessly integrates into Elevance Health’s existing business model. The company has a proven track record of successfully integrating acquired companies, streamlining operations, and improving efficiency. The acquisition provides access to a new pool of skilled professionals and allows for the sharing of best practices across different regions. Furthermore, it strengthens Elevance’s network of providers, enhancing the quality and reach of their healthcare services.

This synergistic effect allows for greater economies of scale and a more streamlined approach to delivering healthcare services. For example, the company might leverage its existing technological infrastructure and data analytics capabilities to improve the efficiency of claims processing and member services in Louisiana.

Potential for Future Acquisitions and Expansions

This acquisition signals a clear intent by Elevance Health to pursue further expansion. The successful integration of the Louisiana plan will serve as a blueprint for future acquisitions, potentially targeting other regional Blue Cross Blue Shield plans or other healthcare providers in strategically important geographic areas. Elevance might prioritize states adjacent to Louisiana or areas with similar demographic profiles and healthcare needs.

This expansion strategy aims to build a truly national healthcare network with consistent branding and operational standards. A potential scenario could involve targeting plans in neighboring states like Texas or Mississippi, creating a contiguous regional dominance.

Comparison with Other Major Healthcare Providers

Elevance Health’s strategic approach contrasts with some competitors who focus on organic growth through internal expansion or strategic partnerships. While some major players focus on building extensive provider networks, Elevance’s strategy seems more geared towards acquiring established market leaders to rapidly increase its market share. This contrasts with providers who favor a more gradual expansion strategy, focusing on building their market position organically.

Elevance’s strategy is faster and more aggressive, potentially yielding higher returns but carrying a higher level of risk associated with integrating acquired entities.

Visual Representation of Elevance Health’s Potential Market Expansion

Imagine a map of the United States. Elevance Health’s current market presence is represented by a cluster of darker shaded states. Following the Louisiana acquisition, a darker shade extends to encompass Louisiana. Future expansion trajectories are depicted as lighter shades extending outwards from Louisiana, potentially towards neighboring states in the South and Southeast, gradually increasing the shaded area over time, showing a gradual but significant expansion across the southern United States.

This illustrates a targeted and strategic approach to expansion, focusing on contiguous areas to leverage synergies and minimize integration challenges.

Conclusion

Source: wwltv.com

The Elevance Health Louisiana acquisition is more than just a simple business deal; it’s a potential catalyst for significant change within the BCBS system and the broader healthcare industry. While the long-term consequences remain uncertain, one thing is clear: this acquisition will likely trigger a period of increased consolidation, reshaping the competitive landscape and potentially impacting access to care, costs, and the quality of services for millions of Americans.

The coming months will be crucial in observing the unfolding consequences of this pivotal moment in healthcare history. Stay tuned for further developments!

FAQ Section

What are the potential antitrust concerns surrounding this acquisition?

Regulators will scrutinize the deal to ensure it doesn’t lead to reduced competition and higher prices for consumers. Concerns about market dominance and reduced choice for patients are key areas of investigation.

How might this affect insurance premiums?

The impact on premiums is uncertain. Increased market share could lead to either price increases due to reduced competition or potential cost savings due to economies of scale, depending on how the merged entity operates.

What is Elevance Health’s overall strategy behind this acquisition?

Elevance likely aims to expand its market share, gain access to new patient populations, and potentially achieve cost synergies through consolidation. The Louisiana acquisition may be a stepping stone towards further expansion in other regions.