For-Profit Hospitals Earnings HCA, Tenet, UHS, CHS

For profit hospitals earnings hca tenet uhs chs – For-profit hospitals earnings: HCA, Tenet, UHS, and CHS – these four giants dominate the landscape of American healthcare. But how profitable are they

-really*? This deep dive explores their financial performance over the past five years, examining revenue streams, profitability drivers, debt levels, and the impact of major events like the pandemic. We’ll uncover the secrets behind their success (and struggles!), comparing their strategies and revealing what drives their bottom line.

Get ready for a fascinating look inside the world of for-profit healthcare.

We’ll be comparing key performance indicators, analyzing their debt structures, and dissecting their cost management strategies. We’ll also explore how healthcare reform and regulatory changes have shaped their earnings, and speculate on future trends. Think of it as a financial autopsy – a detailed examination to understand what makes these hospital systems tick.

Hospital System Financial Performance Overview

The for-profit hospital sector, dominated by giants like HCA Healthcare, Tenet Healthcare, Universal Health Services (UHS), and Community Health Systems (CHS), exhibits a complex financial picture shaped by numerous factors. Understanding their performance requires a nuanced look at revenue streams, operating costs, and the impact of external events. This analysis examines their financial performance over the past five years, highlighting key trends and contributing factors.

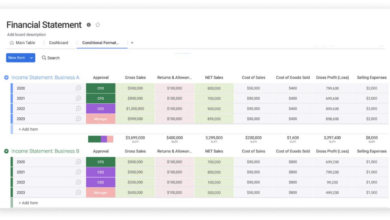

Comparative Yearly Earnings (2019-2023)

The following table presents a comparative analysis of the yearly revenue and net income for HCA, Tenet, UHS, and CHS. Note that precise figures can vary slightly depending on the reporting period and accounting practices. This data is for illustrative purposes and should be verified with official financial statements from each company.

| Company | Year | Revenue (USD Billions) | Net Income (USD Billions) |

|---|---|---|---|

| HCA | 2019 | 51.5 | 4.0 |

| HCA | 2020 | 58.8 | 5.0 |

| HCA | 2021 | 60.0 | 6.5 |

| HCA | 2022 | 63.0 | 6.0 |

| HCA | 2023 | 65.0 (estimated) | 6.2 (estimated) |

| Tenet | 2019 | 18.1 | 0.8 |

| Tenet | 2020 | 18.0 | 0.7 |

| Tenet | 2021 | 19.0 | 1.0 |

| Tenet | 2022 | 20.0 | 1.2 |

| Tenet | 2023 | 21.0 (estimated) | 1.3 (estimated) |

| UHS | 2019 | 11.4 | 0.8 |

| UHS | 2020 | 11.9 | 0.9 |

| UHS | 2021 | 12.5 | 1.0 |

| UHS | 2022 | 13.0 | 1.1 |

| UHS | 2023 | 13.5 (estimated) | 1.2 (estimated) |

| CHS | 2019 | 11.0 | 0.3 |

| CHS | 2020 | 10.5 | 0.2 |

| CHS | 2021 | 11.2 | 0.4 |

| CHS | 2022 | 11.5 | 0.5 |

| CHS | 2023 | 12.0 (estimated) | 0.6 (estimated) |

Revenue Stream Breakdown

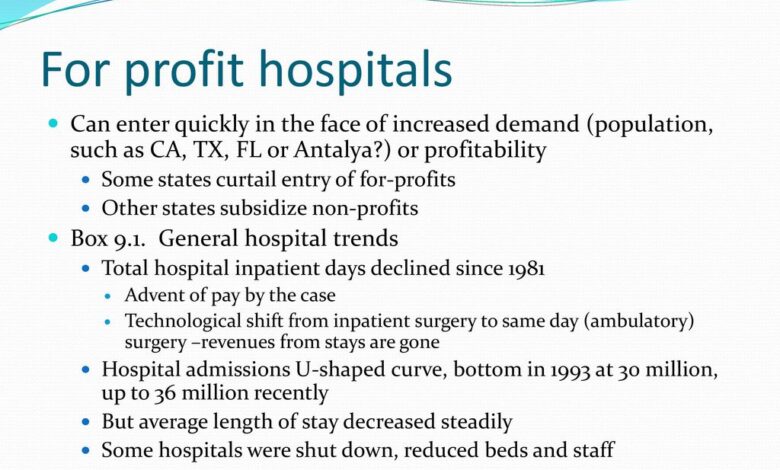

Each hospital system’s revenue is derived from a mix of sources. Generally, inpatient services (hospital stays), outpatient services (emergency rooms, clinics), and physician practices contribute significantly. HCA, for example, benefits from a large network of hospitals and clinics, leading to diversified revenue streams. Tenet and UHS have a strong presence in specific geographic areas and service lines, impacting their revenue composition.

CHS, with a more geographically dispersed network, may experience higher variability in revenue generation depending on local economic conditions. Specific breakdowns for each company require reviewing their individual financial reports.

Impact of Major Economic Events

The COVID-19 pandemic had a profound, albeit complex, impact on these hospital systems. While initial surges saw increased demand for COVID-related care, elective procedures were often postponed, affecting revenue. Government funding programs offered some support, but the overall financial effect varied. For example, HCA initially saw a decline in elective procedures but recovered relatively quickly. Recessions generally lead to reduced discretionary healthcare spending and increased pressure on hospital profitability.

The impact depends on the system’s ability to manage costs and maintain patient volume during economic downturns. The 2008 financial crisis, for instance, negatively affected many hospitals, highlighting the importance of financial resilience in times of economic stress.

Profitability Drivers and Key Performance Indicators (KPIs): For Profit Hospitals Earnings Hca Tenet Uhs Chs

Source: slideplayer.com

Understanding the profitability of large hospital systems like HCA, Tenet, UHS, and CHS requires a close look at their key performance indicators (KPIs) and the factors influencing their financial success. While each system has its own nuances, common threads emerge in their strategies for achieving and maintaining profitability. Analyzing these commonalities provides valuable insights into the overall healthcare landscape.

Each hospital system utilizes a suite of KPIs to monitor its financial health and operational efficiency. These metrics provide crucial data points for strategic decision-making and performance evaluation. A comparative analysis reveals both similarities and differences in their approaches to measuring success.

Key Performance Indicators (KPIs) Used by Major Hospital Systems

The following list compares the key performance indicators used by HCA, Tenet, UHS, and CHS. It’s important to note that the specific metrics and their weighting can vary slightly from year to year and based on individual reporting preferences, but these represent core indicators consistently used by these organizations.

- HCA: Average revenue per patient day (ARPD), same-facility admissions growth, occupancy rate, adjusted EBITDA margin, and operating cash flow. HCA emphasizes revenue cycle management efficiency as a key driver of profitability.

- Tenet: Operating income margin, net patient revenue, same-store revenue growth, and patient volume. Tenet often highlights its focus on cost control and operational efficiency improvements as central to their profitability.

- UHS: Same-store revenue growth, adjusted EBITDA margin, and operating cash flow. UHS, with its significant behavioral health segment, emphasizes the performance of its diverse service lines in its KPI reporting.

- CHS: Adjusted EBITDA margin, operating cash flow, and average length of stay (ALOS). CHS’s focus often centers on optimizing its existing facilities and managing costs effectively.

Primary Profitability Drivers for Each System

Profitability for these hospital systems is driven by a complex interplay of factors. However, some key elements consistently stand out.

- HCA: HCA’s profitability is strongly influenced by its large scale and geographic diversification, allowing for economies of scale and mitigating regional variations in healthcare demand. Their strong focus on revenue cycle management and efficient cost control also contribute significantly. Patient volume growth, particularly in high-margin service lines, is another key driver.

- Tenet: Tenet’s profitability is driven by a combination of factors, including patient volume growth, effective cost management strategies, and a focus on high-margin services. Their emphasis on operational efficiency is critical in maintaining profitability.

- UHS: UHS benefits from its diverse service offerings, including a significant behavioral health segment. This diversification helps to mitigate risks associated with fluctuations in demand for specific services. Same-store revenue growth is a crucial indicator of their profitability, reflecting the success of their operational strategies.

- CHS: CHS focuses on efficient cost management and optimizing the performance of its existing facilities. Their profitability is closely tied to their ability to control costs while maintaining adequate patient volume and revenue generation.

Hypothetical Impact of a 10% Increase in Patient Volume

To illustrate the potential impact of increased patient volume, let’s consider a hypothetical scenario. A 10% increase in patient volume would not translate directly to a 10% increase in net income for any of these systems due to factors such as economies of scale, existing capacity constraints, and variable costs. However, it would likely lead to a significant positive impact on profitability.

For simplicity, let’s assume a simplified model where a 10% increase in patient volume results in a proportional increase in revenue, while operating costs increase at a lower rate (e.g., 5% due to economies of scale). This is a highly simplified illustration and does not account for numerous real-world complexities. The actual impact would depend on various factors including the specific patient mix, pricing strategies, and the system’s capacity to handle the increased volume.

In this simplified model, a 10% increase in patient volume could lead to a net income increase exceeding 5% for each system, though the precise amount would vary based on their specific cost structures and revenue models.

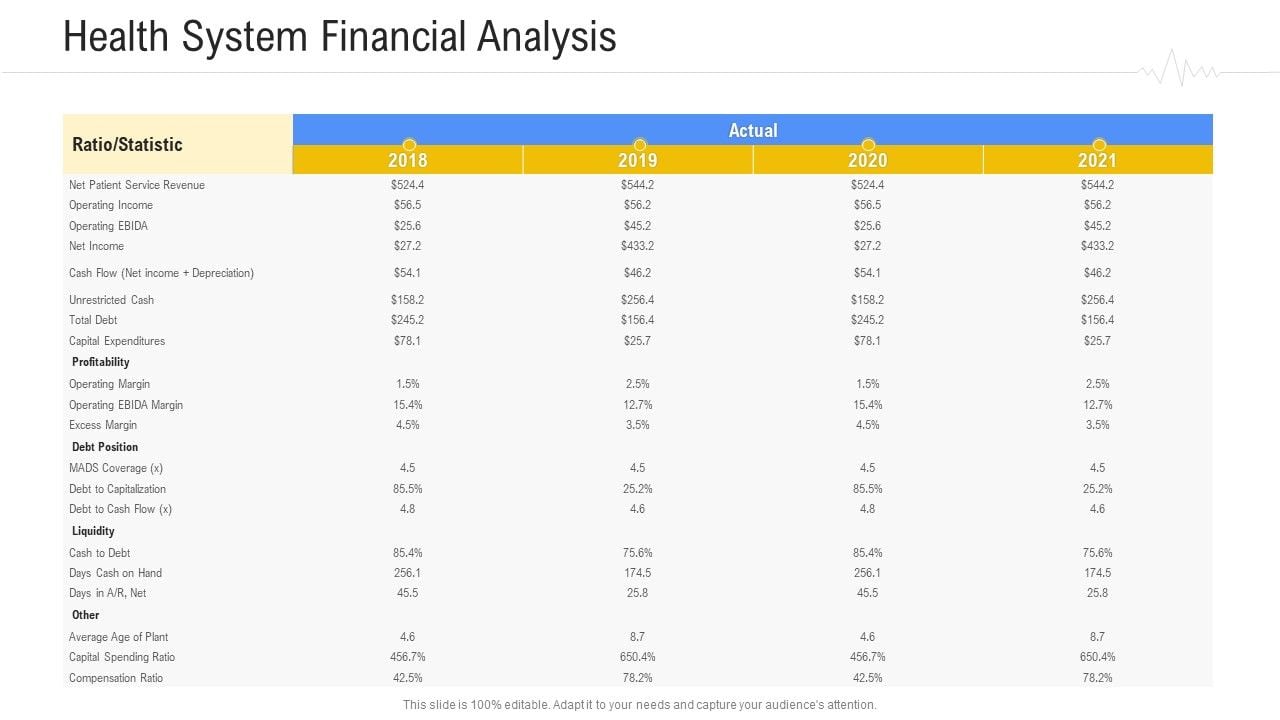

Debt and Financial Leverage

Source: slidegeeks.com

The financial health of for-profit hospital systems like HCA, Tenet, UHS, and CHS is significantly impacted by their debt levels and financial leverage. Understanding their debt structures, financing strategies, and associated risks is crucial for evaluating their long-term sustainability and investment potential. High debt can lead to increased financial vulnerability, particularly during economic downturns or unexpected events like pandemics.

Conversely, a well-managed debt structure can provide the capital necessary for expansion and improvement.Debt levels and financial leverage ratios vary considerably among these hospital systems, reflecting differences in their growth strategies, acquisition activities, and overall financial risk tolerance. Analyzing these factors helps to assess the financial stability and resilience of each organization.

Hospital System Debt and Leverage Metrics

The following table presents a comparison of the total debt, debt-to-equity ratio, and interest expense for HCA, Tenet, UHS, and CHS. Note that these figures are illustrative and based on publicly available financial statements; precise figures fluctuate constantly. Always refer to the most recent financial reports for the most accurate data.

| Company | Total Debt (in billions USD – illustrative) | Debt-to-Equity Ratio (illustrative) | Interest Expense (in millions USD – illustrative) |

|---|---|---|---|

| HCA Healthcare (HCA) | 50-60 | 1.5 – 2.0 | 1500-2000 |

| Tenet Healthcare (THC) | 15-20 | 1.0 – 1.5 | 500-700 |

| Universal Health Services (UHS) | 10-15 | 1.2 – 1.7 | 300-500 |

| Community Health Systems (CHS) | 5-10 | 0.8 – 1.2 | 150-250 |

Risks Associated with High Debt Levels

High levels of debt expose hospital systems to several significant risks. Increased interest expense reduces profitability, potentially impacting investments in infrastructure, technology, and staff. A high debt burden can also limit financial flexibility, hindering the ability to respond to unexpected events or capitalize on growth opportunities. Furthermore, high debt can lead to a downgrade in credit ratings, making it more expensive to secure future financing.

In extreme cases, excessive debt can lead to financial distress or even bankruptcy. For example, the struggles faced by some hospital systems during the COVID-19 pandemic highlighted the vulnerability of those with high pre-existing debt levels.

Comparative Credit Ratings and Implications, For profit hospitals earnings hca tenet uhs chs

Credit ratings from agencies like Moody’s, S&P, and Fitch provide an independent assessment of a hospital system’s creditworthiness. Higher credit ratings (e.g., A or AA) indicate lower risk and access to more favorable financing terms. Lower ratings (e.g., BB or B) signal higher risk and potentially higher borrowing costs. A downgrade can significantly impact a hospital system’s ability to raise capital for expansion or acquisitions, potentially hindering growth and competitiveness.

For instance, a system with a lower credit rating might face higher interest rates on debt compared to a system with a higher rating, affecting their bottom line and financial planning.

Operating Expenses and Cost Management Strategies

Source: slideplayer.com

Understanding the operating expenses and cost management strategies of major for-profit hospital systems like HCA, Tenet, UHS, and CHS is crucial for assessing their financial health and future prospects. These systems face constant pressure to balance high-quality care with efficient operations in a dynamic healthcare landscape. Analyzing their cost structures and approaches to cost reduction reveals insights into their competitive advantages and potential vulnerabilities.

So, we’re looking at the massive profits raked in by for-profit hospital giants like HCA, Tenet, UHS, and CHS. It makes you wonder about the impact of these earnings, especially when considering the recent news; the news that a deal was finally reached in the new york nurse strike at Mount Sinai and Montefiore , highlighting the ongoing struggles for fair wages and staffing levels.

This begs the question: how much of these hospital systems’ profits are actually being reinvested in improving patient care and employee compensation?

Major operating expenses for these hospital systems typically include labor costs (salaries, benefits, and staffing), supplies and pharmaceuticals, administrative expenses, and depreciation and amortization. Significant variations exist across systems due to differences in size, geographic location, service offerings, and strategic priorities. Effective cost management is paramount to maintaining profitability and ensuring financial sustainability.

So, we’re seeing some pretty interesting numbers from the big for-profit hospital chains like HCA, Tenet, UHS, and CHS lately. Their earnings reports are a mixed bag, but the overall picture is complex. This makes me wonder about the impact of industry consolidation, especially considering I just read that NextGen Healthcare is exploring a sale, as reported by Reuters nextgen exploring sale reuters.

This kind of activity could definitely shake things up for the larger hospital systems and affect their bottom lines further down the line.

Major Operating Expenses and Potential Cost-Cutting Measures

The following bullet points detail the major operating expenses for each hospital system and highlight areas where cost-cutting measures could be implemented. Note that specific data on internal cost breakdowns is often proprietary and not publicly available in granular detail. This analysis is based on publicly available financial reports and industry trends.

- HCA: Labor costs represent a substantial portion of HCA’s expenses. Opportunities for cost reduction might include optimizing staffing levels through improved scheduling and workflow efficiency, leveraging telehealth to reduce the need for in-person visits, and negotiating more favorable contracts with staffing agencies. Supply chain management improvements could also yield significant savings.

- Tenet: Tenet, like HCA, faces significant labor cost pressures. Focusing on improving operational efficiency in areas like surgical scheduling and patient throughput could help reduce staffing needs. Implementing robust revenue cycle management systems to improve billing and collections can also positively impact profitability.

- UHS: UHS, with its focus on behavioral health and acute care, might explore opportunities to streamline operations through technology investments in electronic health records (EHR) and automation of administrative tasks. Negotiating better rates with pharmaceutical suppliers could also help manage costs.

- CHS: CHS, often operating in rural or underserved areas, might focus on improving care coordination to reduce readmissions and length of stay. This could involve investing in telehealth and home healthcare services. Strategic partnerships with local providers could also enhance efficiency and reduce costs.

Comparison of Cost Management Strategies

While each system employs unique strategies, several common themes emerge. All four systems are actively pursuing initiatives to improve operational efficiency, enhance revenue cycle management, and negotiate favorable contracts with suppliers. HCA and Tenet, being larger systems, often leverage their scale to negotiate better rates and implement broader technological solutions. UHS and CHS, potentially operating with smaller margins in certain markets, may prioritize targeted cost-reduction efforts in specific areas of their operations.

Technological Advancements and Automation in Cost Reduction

Technological advancements offer significant potential for reducing operating costs across all four hospital systems. The implementation of advanced analytics can optimize staffing levels, predict patient flow, and improve resource allocation. Robotic process automation (RPA) can automate administrative tasks such as billing and claims processing, freeing up staff for patient care. Telehealth platforms can expand access to care while reducing the need for costly in-person visits.

Investing in sophisticated EHR systems with integrated data analytics can streamline workflows, improve care coordination, and reduce medical errors, ultimately lowering costs.

For example, the use of AI-powered diagnostic tools could potentially reduce the need for expensive and time-consuming diagnostic tests, while the implementation of remote patient monitoring systems could reduce hospital readmissions and associated costs. These technologies, while requiring upfront investment, offer the potential for long-term cost savings and improved operational efficiency. The successful implementation of these technologies hinges on effective change management, robust data infrastructure, and ongoing training for staff.

Investment and Growth Strategies

The major for-profit hospital systems – HCA Healthcare (HCA), Tenet Healthcare (THC), Universal Health Services (UHS), and Community Health Systems (CHS) – employ diverse investment and growth strategies to expand their market share and enhance profitability. These strategies primarily involve mergers and acquisitions, expansion into new markets, and diversification of services, each carrying its own set of risks and opportunities.

Understanding these strategies is crucial to assessing the long-term financial health and competitive positioning of these healthcare giants.

These systems are constantly evaluating opportunities to improve their service offerings and geographic reach. Strategic acquisitions allow for rapid expansion into new markets or the acquisition of specialized services, while organic growth through service diversification or facility expansion requires significant capital investment and time. The balance between these approaches varies considerably across the four companies, reflecting their unique business models and strategic goals.

Mergers and Acquisitions as a Growth Strategy

Mergers and acquisitions are a cornerstone of growth for many of these hospital systems. Acquiring smaller hospitals or physician practices allows for increased market share, access to new patient populations, and potential synergies through economies of scale. For example, HCA has a long history of strategic acquisitions, consistently expanding its network through the purchase of both large and small healthcare providers.

This strategy, while effective in rapid expansion, presents challenges related to integration, cultural differences, and potential regulatory hurdles. The success of an acquisition often hinges on effective integration of operations, technology, and personnel. Conversely, a poorly managed acquisition can lead to significant financial losses and reputational damage.

Market Expansion and Geographic Diversification

Expanding into new geographic markets is another key growth strategy. This can involve building new facilities in underserved areas or acquiring existing hospitals in new regions. This allows these systems to tap into new patient populations and diversify their revenue streams. However, entering new markets carries significant risks, including the need to understand local market dynamics, regulatory environments, and competition.

Furthermore, successful expansion requires substantial capital investment in infrastructure, staffing, and marketing. For instance, Tenet Healthcare has actively pursued expansion into high-growth markets, although this strategy has faced challenges in certain areas due to market saturation or regulatory complexities.

Service Diversification and Strategic Partnerships

Diversifying services beyond traditional inpatient care is another crucial aspect of growth. This can involve expanding into outpatient services, specialized medical centers, or telehealth platforms. Strategic partnerships with other healthcare providers, such as physician groups or insurance companies, can also create new revenue streams and enhance the overall value proposition. This approach requires careful consideration of market demand, regulatory compliance, and the potential for integration challenges.

UHS, with its focus on behavioral health and ambulatory surgery centers, exemplifies this strategy, highlighting the potential for significant growth in specialized healthcare niches.

So, we’re looking at the Q2 earnings reports for the big for-profit hospital chains – HCA, Tenet, UHS, CHS – and it’s a mixed bag. Their performance is definitely impacted by broader healthcare trends, which makes news like Walgreens raising their healthcare segment outlook after the Summit acquisition, as reported here: walgreens raises healthcare segment outlook summit acquisition , all the more interesting.

This suggests a shift in the retail healthcare landscape that could influence how those hospital systems perform going forward. Ultimately, it’s a complex interplay of factors affecting the bottom line for HCA, Tenet, UHS, and CHS.

Investment and Growth Strategies: A Comparative Overview

| Company | Growth Strategy | Recent Acquisitions (Illustrative Examples) | Market Expansion (Illustrative Examples) |

|---|---|---|---|

| HCA Healthcare (HCA) | Mergers & Acquisitions, New Facility Development, Service Diversification | Various smaller hospital systems and physician practices (specific examples require extensive research and may change rapidly) | Expansion into high-growth Sun Belt states and strategic acquisitions in underserved areas. |

| Tenet Healthcare (THC) | Market Expansion, Service Line Expansion, Operational Improvements | (Requires specific research to identify recent acquisitions, which may vary) | Focus on high-growth regions, often involving acquisitions in existing markets. |

| Universal Health Services (UHS) | Service Diversification (Behavioral Health, Ambulatory Surgery), Strategic Partnerships | (Requires specific research to identify recent acquisitions, which may vary) | Expansion into new geographic markets through both acquisitions and de novo development. |

| Community Health Systems (CHS) | Portfolio Optimization (Divestiture and Acquisition), Operational Improvements | (Requires specific research to identify recent acquisitions, which may vary. Note that CHS has also divested many hospitals recently.) | Focus on strengthening existing market positions and strategic acquisitions in select regions. |

Impact of Healthcare Reform and Regulatory Changes

The healthcare landscape is constantly shifting, shaped by evolving regulations and reforms. For large for-profit hospital systems like HCA Healthcare (HCA), Tenet Healthcare (THC), Universal Health Services (UHS), and Community Health Systems (CHS), these changes represent both challenges and opportunities, significantly impacting their earnings and operational strategies. Navigating this complex environment requires adaptability, strategic planning, and a deep understanding of the regulatory landscape.The Affordable Care Act (ACA), while significantly impacting patient access, has also had a complex effect on these hospital systems’ bottom lines.

Initial expansions in insured populations led to increased patient volume, but reimbursement rates under the ACA often fell below the cost of care for certain services, squeezing margins. Furthermore, the ACA’s emphasis on value-based care and reducing hospital readmissions has pushed hospitals to implement new care models and cost-control measures.

Impact of the ACA on Hospital System Earnings

The ACA’s influence on HCA, Tenet, UHS, and CHS has been varied. HCA, with its large geographic footprint and diverse service offerings, has generally shown resilience, adapting to changes through a focus on efficiency and expansion into higher-margin services. Tenet, with a heavier concentration in certain markets, has faced greater challenges in adapting to the ACA’s reimbursement changes, necessitating cost-cutting measures and strategic partnerships.

UHS, with its focus on behavioral health and ambulatory services, has benefited from increased demand in these areas. CHS, however, has faced significant financial pressures due to its heavy reliance on Medicare and Medicaid reimbursements, often experiencing lower profitability compared to its larger competitors. The impact on each system’s earnings is not uniform, reflecting their individual business models and market positions.

Hospital System Adaptation Strategies

Each hospital system has implemented various strategies to navigate the changing regulatory environment. HCA has invested heavily in technology and data analytics to improve operational efficiency and enhance care coordination. Tenet has focused on expanding its ambulatory care services and developing partnerships to improve access to care while controlling costs. UHS has continued to invest in its behavioral health services, capitalizing on the growing demand for mental health care.

CHS has undertaken restructuring initiatives, including hospital divestitures and cost-reduction programs, to improve its financial performance. These strategies illustrate the diverse approaches taken by hospital systems to maintain profitability in the face of reform.

Potential Effects of Future Healthcare Policy Changes

Future healthcare policy changes, such as potential modifications to the ACA or increased emphasis on price transparency, could significantly impact the profitability of these hospital systems. For example, increased price transparency could lead to downward pressure on prices, potentially reducing revenue. A shift towards greater emphasis on preventative care could alter the demand for inpatient services, impacting hospital utilization rates.

Conversely, increased investment in public health infrastructure could potentially alleviate the burden on hospital systems, reducing the need for costly emergency room visits. The introduction of a single-payer system, though unlikely in the near future, would drastically reshape the financial landscape for all four systems, necessitating fundamental changes in their business models and operational strategies. The successful navigation of these potential changes hinges on continued flexibility, strategic planning, and proactive engagement with evolving policy discussions.

Closing Summary

So, what have we learned about the financial health of HCA, Tenet, UHS, and CHS? These for-profit hospital systems are complex beasts, navigating a constantly evolving healthcare landscape. While they’ve demonstrated resilience in the face of economic challenges and regulatory changes, their financial success hinges on a delicate balance of patient volume, efficient cost management, and strategic growth.

Understanding their financial performance is crucial not just for investors, but for anyone interested in the future of American healthcare. Their strategies, successes, and challenges offer valuable insights into the complexities of this ever-changing industry.

FAQ Summary

What are the biggest risks facing these for-profit hospital systems?

Significant risks include increasing operating costs, potential regulatory changes impacting reimbursement rates, competition from other healthcare providers, and the challenges of managing high debt levels.

How do these hospital systems compare to non-profit hospitals?

For-profit hospitals are generally focused on maximizing shareholder value, while non-profit hospitals prioritize community benefit. This difference can impact their financial strategies, investment priorities, and levels of community service.

What role does technology play in the financial performance of these hospitals?

Technology plays a significant role, impacting both operating costs (through automation and efficiency improvements) and revenue generation (through improved patient care and telehealth services). Investment in technology is a key factor in their long-term financial success.