Hospitals Revenue Medicare, Insurers, & Moodys

Hospitals revenue medicare advantage insurers moodys ratings – Hospitals revenue, Medicare Advantage insurers, and Moody’s ratings – these three elements are inextricably linked, creating a fascinating financial dance within the healthcare industry. The growth of Medicare Advantage plans significantly impacts hospital revenue streams, forcing institutions to adapt their strategies and negotiate effectively with powerful insurers. Meanwhile, Moody’s ratings, reflecting a hospital’s financial health, influence their access to capital and overall stability.

This intricate interplay shapes the landscape of hospital finance, highlighting both opportunities and challenges.

Understanding this complex relationship is crucial for anyone interested in the future of healthcare finance. We’ll delve into the details of Medicare Advantage reimbursement models, analyze the impact of insurer negotiating power, and examine how Moody’s ratings affect hospital access to funding. We’ll also explore risk mitigation strategies and the importance of financial forecasting in this ever-evolving environment.

Get ready for a deep dive into the numbers!

Medicare Advantage and Hospital Revenue

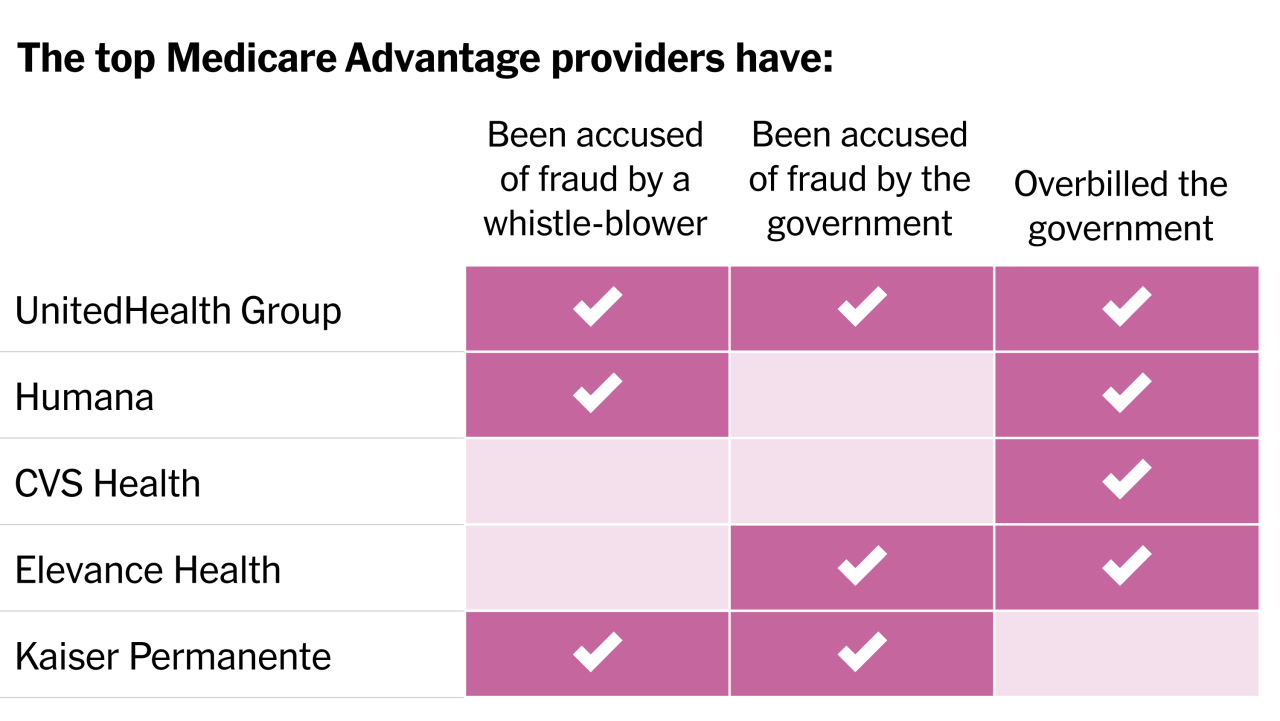

Source: yimg.com

The rise of Medicare Advantage (MA) plans has significantly reshaped the healthcare landscape, creating both opportunities and challenges for hospitals. Understanding the complex interplay between MA enrollment growth and hospital revenue is crucial for navigating this evolving environment. This discussion will explore the impact of MA payment models on hospital profitability and strategies hospitals are employing to succeed in this new paradigm.Medicare Advantage enrollment growth directly influences hospital revenue.

As more seniors opt for MA plans, a larger portion of Medicare reimbursements flows through these private insurers rather than directly from the government. This shift alters the payment dynamics and the revenue streams hospitals receive. The rate of growth in MA enrollment, therefore, directly impacts the volume of patients hospitals see who are covered under these plans, affecting their overall financial performance.

Impact of Medicare Advantage Payment Models on Hospital Profitability

Medicare Advantage plans utilize various payment models, including capitation, bundled payments, and fee-for-service arrangements. These models can significantly affect hospital profitability. Capitation, for instance, where hospitals receive a fixed payment per enrollee regardless of services rendered, incentivizes cost-effective care and efficient resource allocation. However, it also introduces financial risk, as hospitals must manage costs effectively to avoid losses. Bundled payments, covering a defined set of services for a specific episode of care, can improve efficiency and reduce unnecessary spending, but require careful coordination of care and accurate cost projections.

Fee-for-service arrangements within MA, while similar to traditional Medicare, often involve negotiated rates that can be lower than those in traditional Medicare, impacting margins.

Reimbursement Rates Under Medicare Advantage and Traditional Medicare, Hospitals revenue medicare advantage insurers moodys ratings

Reimbursement rates for the same services often differ between Medicare Advantage and traditional Medicare. MA plans negotiate rates with hospitals, which can be lower than the rates set by the Centers for Medicare & Medicaid Services (CMS) for traditional Medicare. This difference varies by service, geographic location, and the specific MA plan. For example, a hospital might receive a lower reimbursement for a hip replacement surgery under an MA plan compared to the same procedure billed under traditional Medicare.

The extent of this difference impacts a hospital’s profitability, particularly if a significant portion of its patient population is enrolled in MA plans. This necessitates efficient cost management and strategic pricing negotiations with MA plans.

Hospitals rely heavily on Medicare Advantage insurers for revenue, and Moody’s ratings reflect this complex relationship. The recent FTC lawsuit blocking the Novant Health and Community Health Systems merger, as reported in this article , highlights the regulatory scrutiny impacting hospital finances. This decision could significantly alter the competitive landscape, further influencing hospital revenue streams and, ultimately, their Moody’s ratings.

Hospital Adaptation Strategies in the Medicare Advantage Landscape

Hospitals are actively adapting their strategies to thrive in the growing Medicare Advantage market. Many are investing in population health management programs, aiming to improve patient outcomes and reduce costs through proactive care and disease prevention. This includes expanding telehealth services, enhancing care coordination, and implementing data analytics to identify high-risk patients and intervene early. Another key strategy involves strengthening relationships with MA plans through effective contract negotiations and value-based care arrangements.

Hospitals are also focusing on improving operational efficiency, streamlining administrative processes, and reducing unnecessary hospital readmissions to enhance profitability within the constraints of MA reimbursement rates. For example, some hospitals are forming partnerships with post-acute care providers to ensure seamless transitions and reduce readmissions, a key performance indicator often factored into MA payment models. Finally, focusing on high-value services and procedures that command higher reimbursement rates, even within the MA framework, allows for financial stability and growth.

Moody’s Ratings and Hospital Financial Health

Source: nyt.com

Moody’s Investors Service plays a crucial role in the healthcare finance landscape by providing credit ratings for hospitals. These ratings reflect the perceived creditworthiness of a hospital, influencing its ability to access capital and impacting its overall financial health. Understanding how Moody’s assesses hospitals is vital for both healthcare providers and investors.

Factors Considered in Moody’s Hospital Credit Ratings

Moody’s employs a comprehensive framework to evaluate hospital creditworthiness. This framework considers both quantitative and qualitative factors. Quantitative factors include financial metrics such as operating performance, debt levels, and liquidity. Qualitative factors encompass market position, management quality, and the overall economic environment. The interplay of these factors ultimately determines the assigned rating.

A strong financial profile coupled with a favorable market position and effective management typically results in a higher rating. Conversely, weaknesses in any of these areas can lead to a lower rating.

Key Financial Indicators Used by Moody’s

Several key financial indicators are central to Moody’s assessment of hospital creditworthiness. These indicators provide a snapshot of the hospital’s financial strength and stability. Crucially, Moody’s examines operating profitability (measured by operating margin), debt levels (including the ratio of debt to capital), and liquidity (the ability to meet short-term obligations). They also analyze key metrics such as days cash on hand and revenue per adjusted discharge.

The trend of these indicators over time is also carefully considered, reflecting the hospital’s financial trajectory. A consistent improvement in these metrics typically indicates a positive outlook, whereas a deterioration suggests increased risk.

Moody’s ratings on hospital revenue, heavily influenced by Medicare Advantage insurer reimbursements, are facing pressure. The key to improving efficiency and potentially boosting those ratings might lie in embracing innovative technologies; check out this article on how AI, connected medicine, and UPMC’s technology center are transforming healthcare. Ultimately, adopting these advancements could significantly impact a hospital’s bottom line and its Moody’s rating.

Impact of Moody’s Ratings on Access to Capital

Moody’s ratings directly influence a hospital’s access to capital. Hospitals with higher ratings generally enjoy better access to financing at more favorable terms. This is because a higher rating signals lower credit risk to lenders, making them more willing to provide loans at lower interest rates. Conversely, hospitals with lower ratings may face difficulties securing financing, potentially at higher interest rates or with stricter lending conditions.

This disparity in access to capital can significantly impact a hospital’s ability to invest in infrastructure, technology, and personnel, potentially hindering its growth and competitiveness.

Examples of Hospitals with Different Moody’s Ratings and Their Financial Performance

The following table illustrates how different Moody’s ratings can correlate with varying financial performance across hospitals. It’s important to note that this is a simplified example, and actual financial data is far more complex and influenced by many additional factors. Further, the selection of these hypothetical hospitals does not reflect any real-world institutions.

| Hospital Name | Moody’s Rating | Revenue (USD Millions) | Debt (USD Millions) | Operating Margin (%) |

|---|---|---|---|---|

| Hospital A | Aa3 | 1500 | 500 | 5 |

| Hospital B | Baa1 | 750 | 200 | 3 |

| Hospital C | Ba1 | 300 | 100 | 1 |

Insurer Influence on Hospital Revenue

Medicare Advantage (MA) plans wield significant influence over hospital revenue, shaping reimbursement rates and impacting hospital financial health. Their negotiating power, contracting strategies, and adherence to network adequacy requirements all contribute to a complex interplay affecting hospital profitability and operational decisions. Understanding these dynamics is crucial for hospitals to navigate the evolving landscape of healthcare financing.

Negotiating Power of Large Medicare Advantage Insurers

Large MA insurers possess considerable bargaining leverage when negotiating contracts with hospitals. Their substantial enrollment numbers translate into a large volume of patients, making them attractive partners for hospitals seeking to fill beds and maintain consistent patient flow. Conversely, this also gives insurers significant power to dictate reimbursement rates. Hospitals facing pressure to maintain profitability might be compelled to accept lower rates than they would ideally prefer to secure a contract with a large MA insurer.

This power imbalance is particularly pronounced in markets with limited competition among MA plans, giving the dominant insurer(s) even greater leverage. For example, in a region where one MA plan controls 70% of the market, hospitals are essentially forced to negotiate on the insurer’s terms to retain a substantial portion of their patient base.

Contracting Strategies Employed by Different Medicare Advantage Insurers

Different MA insurers employ varied contracting strategies. Some favor narrow networks, contracting with a limited number of high-performing hospitals to keep costs down and potentially offer lower premiums to enrollees. This strategy can significantly impact hospitals excluded from the network, potentially leading to revenue loss. Other insurers adopt broader network strategies, contracting with a wider range of hospitals to provide enrollees with greater choice.

This approach might result in higher reimbursement rates for hospitals, but it could also lead to higher premiums for enrollees. Finally, some insurers utilize a tiered network approach, offering different levels of coverage and cost-sharing based on the hospital’s participation tier. This complex approach requires hospitals to carefully weigh the benefits and drawbacks of each tier to determine the most advantageous participation level.

Impact of Network Adequacy Requirements on Hospital Revenue

Network adequacy requirements, mandated by CMS, aim to ensure that MA plans offer sufficient access to care for their enrollees. These requirements dictate the minimum number and types of providers (including hospitals) a plan must contract with to meet the needs of its members within a specific geographic area. While intended to protect beneficiaries, these requirements can indirectly impact hospital revenue.

Hospitals that fail to meet the plan’s criteria for network inclusion may lose a significant portion of their potential MA patient volume. Conversely, meeting these requirements may involve accepting lower reimbursement rates to secure a contract, creating a trade-off between access and profitability. Failure to meet network adequacy standards can result in penalties for the insurer, but this does not necessarily translate to increased revenue for the excluded hospital.

Hypothetical Negotiation Scenario Between a Hospital and a Major Medicare Advantage Insurer

Imagine a negotiation between “City General Hospital” and “MegaHealth MA,” a large insurer. MegaHealth MA proposes a significant reduction in reimbursement rates for all services, citing a need to control costs and maintain competitive premiums. City General Hospital argues that the proposed rates are unsustainable, jeopardizing its financial stability and ability to invest in infrastructure and staff. A key point of contention is the inclusion of specialized services, like cardiac care, where City General Hospital has a strong reputation.

MegaHealth MA might pressure City General to accept lower rates for these services, leveraging their market power and the hospital’s dependence on their patient volume. The negotiation hinges on balancing MegaHealth MA’s desire for cost containment with City General Hospital’s need for fair compensation to maintain quality care. Ultimately, the outcome depends on the relative bargaining power of each party and the broader market dynamics.

Financial Performance Analysis

Analyzing the financial performance of hospitals in relation to their reliance on Medicare Advantage revenue reveals a complex picture. While Medicare Advantage offers a significant revenue stream, the reimbursement rates and payment structures can significantly impact a hospital’s overall profitability and financial stability. Understanding this relationship is crucial for both hospitals and policymakers.

A key aspect of this analysis involves comparing hospitals with varying degrees of Medicare Advantage penetration. Hospitals heavily reliant on Medicare Advantage payments might face different financial challenges compared to those with a more diversified payer mix. This analysis will examine how different levels of Medicare Advantage revenue influence key financial metrics, shedding light on the financial health of hospitals within this specific segment.

Medicare Advantage Penetration and Hospital Profitability

The relationship between a hospital’s reliance on Medicare Advantage revenue and its operating margin can be visualized using a scatter plot. The X-axis represents the percentage of total revenue derived from Medicare Advantage plans. The Y-axis displays the hospital’s operating margin (operating income divided by operating revenue). The plot would ideally show a positive correlation, suggesting that as Medicare Advantage penetration increases, so does the hospital’s operating margin.

However, the strength of this correlation would need to be analyzed statistically. Some hospitals might show higher profitability due to efficient management and negotiation of contracts, while others may experience lower margins due to factors such as higher patient acuity or lower reimbursement rates in their specific Medicare Advantage contracts. This scatter plot would visually represent the complex interplay between revenue source and financial success.

Outliers on the plot would warrant further investigation to understand why certain hospitals deviate from the general trend. For example, a hospital with high Medicare Advantage penetration but low operating margin might be experiencing high costs or inefficiencies in its operations. Conversely, a hospital with low Medicare Advantage penetration but high operating margin might have successfully negotiated favorable contracts with other payers or have implemented cost-saving measures.

Key Financial Ratios for Assessing Hospital Financial Health

Several key financial ratios can be used to assess the financial health of hospitals with a high reliance on Medicare Advantage payments. These ratios provide a more comprehensive picture than simply looking at operating margin alone.

For instance, the operating margin itself is a crucial indicator of profitability. A consistently low operating margin, particularly in the context of high Medicare Advantage reliance, suggests potential challenges with reimbursement rates or cost management. A declining operating margin over time could signal worsening financial performance.

The debt-to-equity ratio measures a hospital’s financial leverage. A high debt-to-equity ratio indicates that a hospital is financing a substantial portion of its operations with debt, increasing its financial risk. Hospitals heavily reliant on Medicare Advantage, often facing lower and less predictable reimbursements, might find it challenging to manage high debt levels, potentially leading to financial distress. For example, a hospital with a debt-to-equity ratio of 2.0 indicates that it has twice as much debt as equity, signifying higher risk compared to a hospital with a ratio of 0.5.

Other relevant ratios include the days cash on hand (DCOH), which indicates the number of days a hospital can cover its operating expenses with its readily available cash. A low DCOH, especially for hospitals heavily reliant on Medicare Advantage payments that may experience payment delays, could signal liquidity issues. Further, the current ratio (current assets divided by current liabilities) can assess the hospital’s ability to meet its short-term obligations.

A current ratio below 1 suggests that the hospital may struggle to meet its short-term debts.

Risk and Mitigation Strategies

Source: arkansasadvocate.com

Hospitals increasingly rely on Medicare Advantage (MA) plans for reimbursement, creating significant financial vulnerabilities. Fluctuations in MA payments, complex contract negotiations, and the inherent uncertainties of the MA market pose substantial challenges to hospital financial stability. Understanding and proactively managing these risks is crucial for ensuring long-term viability.

Hospitals are constantly juggling revenue streams, especially with the complexities of Medicare Advantage insurers and their impact on Moody’s ratings. The recent financial struggles highlighted by Steward Health Care’s near-bankruptcy, as reported in this article steward health care secures financing bankruptcy , underscore the pressure these factors put on hospital finances. Ultimately, understanding these dynamics is crucial for predicting future hospital performance and their creditworthiness.

Key Financial Risks Associated with Medicare Advantage Reimbursement

The dependence on MA reimbursement exposes hospitals to several key financial risks. These risks stem from the inherent variability in MA payment methodologies, the complexities of MA contracts, and the competitive landscape of the MA market. Underestimating these risks can lead to significant financial shortfalls and jeopardize the hospital’s ability to provide quality care.

- Payment Rate Volatility: MA plans negotiate rates with hospitals, leading to potential variations in reimbursement compared to traditional Medicare. These fluctuations can be unpredictable and significantly impact revenue projections.

- Network Adequacy and Market Share: MA plans prioritize contracting with hospitals offering comprehensive services at competitive rates. Hospitals not included in preferred networks may experience reduced patient volume and revenue.

- Contractual Complexity and Negotiation Challenges: MA contracts are often complex and require significant negotiation expertise. Failure to secure favorable terms can result in lower reimbursement rates and financial losses.

- Risk of Non-Payment or Delayed Payments: Delays or disputes in MA payments can disrupt hospital cash flow and negatively impact financial stability.

- Underestimating Patient Costs: Accurately predicting the cost of caring for MA patients can be challenging due to variations in patient demographics, health conditions, and the complexities of MA benefits.

Strategies for Mitigating Financial Risks

Hospitals can implement various strategies to mitigate the financial risks associated with MA reimbursement. A proactive and multi-faceted approach is essential to ensure financial resilience in the face of market uncertainties.

- Diversify Revenue Streams: Reducing reliance on a single payer by actively pursuing other revenue sources, such as commercial insurance, self-pay patients, and philanthropy, can help buffer against fluctuations in MA payments.

- Sophisticated Contract Negotiation: Employing skilled negotiators with expertise in MA contracts is crucial to secure favorable reimbursement rates and contract terms.

- Data Analytics and Predictive Modeling: Utilizing robust data analytics to accurately predict patient volume, costs, and reimbursement rates under different scenarios can improve financial forecasting and decision-making.

- Strengthening Financial Management: Implementing rigorous financial management practices, including careful budgeting, cost control, and efficient revenue cycle management, can enhance the hospital’s ability to weather financial challenges.

- Strategic Partnerships: Collaborating with other healthcare providers or forming integrated delivery networks can improve negotiating power with MA plans and enhance market competitiveness.

Examples of Successful Risk Mitigation Strategies

Several hospitals have successfully implemented strategies to mitigate MA-related financial risks. For example, some hospitals have invested heavily in data analytics to accurately predict MA patient volumes and costs, allowing for better resource allocation and improved financial planning. Others have diversified their payer mix by actively pursuing commercial insurance contracts and developing strong relationships with physician groups. Successful negotiation of MA contracts, including favorable payment rates and risk-sharing arrangements, has also been a key factor in mitigating financial risks.

One specific example could be a hospital system successfully negotiating a bundled payment arrangement with a major MA plan, leading to predictable revenue streams and improved financial stability.

The Role of Financial Forecasting and Modeling

Financial forecasting and modeling play a critical role in managing the uncertainties associated with MA payments. By developing sophisticated models that incorporate various scenarios, including changes in payment rates, patient volume, and cost structures, hospitals can better anticipate potential financial challenges and proactively implement mitigation strategies. These models can also assist in strategic decision-making, such as determining the optimal level of MA participation and identifying areas for cost reduction.

For example, a hospital might use a Monte Carlo simulation to assess the probability of achieving a specific financial target under different MA reimbursement scenarios, informing decisions about resource allocation and capital investment.

Closing Summary: Hospitals Revenue Medicare Advantage Insurers Moodys Ratings

The financial health of hospitals is undeniably tied to the intricacies of Medicare Advantage, insurer negotiations, and Moody’s credit ratings. Navigating this complex landscape requires a keen understanding of reimbursement models, market dynamics, and proactive risk management. By adapting strategies and embracing financial forecasting, hospitals can enhance their resilience and secure their future in an increasingly competitive healthcare market.

The key takeaway? Staying informed and adaptable is the key to survival and success in this dynamic sector.

Common Queries

What are the biggest challenges hospitals face in negotiating with Medicare Advantage insurers?

Hospitals often struggle with low reimbursement rates, complex contract terms, and the pressure to maintain network adequacy while balancing profitability.

How do Moody’s ratings directly impact a hospital’s ability to borrow money?

A higher Moody’s rating signifies lower risk, leading to better interest rates and easier access to loans. Lower ratings make borrowing more expensive or even impossible.

Can a hospital improve its Moody’s rating?

Yes, by improving its financial performance (e.g., increasing operating margin, reducing debt), a hospital can positively influence its rating.

What are some alternative revenue streams hospitals are exploring to lessen their reliance on Medicare Advantage?

Hospitals are increasingly focusing on outpatient services, telehealth, value-based care models, and expanding into niche specialties.