Humana Earnings Outlook Cut High Medical Costs

Humana earnings outlook cut high medical costs – that’s the headline grabbing everyone’s attention in the healthcare world right now. Soaring medical expenses are squeezing Humana’s profits, forcing them to revise their earnings predictions downwards. This isn’t just about numbers on a spreadsheet; it’s a reflection of the broader challenges facing the entire healthcare industry, from rising drug prices to the increasing complexity of modern medical treatments.

This post dives deep into the reasons behind Humana’s revised outlook, exploring the factors driving up medical costs and examining the strategies Humana is employing to navigate this turbulent financial landscape.

We’ll dissect Humana’s recent financial performance, comparing it to previous quarters and years. We’ll break down the specific types of medical procedures driving the cost increases and illustrate the proportions visually. Then, we’ll look at Humana’s cost-cutting strategies, compare them to their competitors, and explore the impact on Medicare Advantage and individual plans. It’s a complex issue, but by the end, you’ll have a clearer understanding of the challenges Humana faces and what the future might hold.

Humana’s Financial Performance

Source: wsj.net

Humana, a major player in the health insurance industry, has experienced fluctuating financial performance recently, largely influenced by the ever-increasing costs of medical care. Understanding their financial reports requires examining both their revenue streams and expenditure categories to gain a comprehensive view of their overall health. This analysis will focus on a recent quarter’s performance, comparing it to previous periods to identify trends and assess the impact of rising medical expenses.

Humana’s revenue is primarily generated through premiums from its individual, group, and Medicare Advantage plans. Other revenue sources include government reimbursements and ancillary services. Expenditures, on the other hand, are heavily influenced by medical costs, including payments to healthcare providers, prescription drug costs, and administrative expenses. The delicate balance between these revenue streams and expenditures significantly impacts Humana’s profitability.

Humana’s Q3 2023 Earnings Compared to Previous Periods

The following table compares Humana’s key financial metrics for Q3 2023 with Q2 2023 and Q3 2022. Note that these figures are hypothetical examples for illustrative purposes and should not be considered actual financial data. To obtain accurate data, refer to Humana’s official financial reports.

| Metric | Q3 2023 (Hypothetical) | Q2 2023 (Hypothetical) | Q3 2022 (Hypothetical) |

|---|---|---|---|

| Revenue (in billions) | $25.5 | $24.0 | $22.0 |

| Net Income (in billions) | $1.8 | $1.5 | $1.2 |

| EPS | $8.50 | $7.00 | $5.50 |

| Operating Margin | 12% | 10% | 9% |

This hypothetical data suggests growth in revenue and profitability from Q2 2023 to Q3 2023, and also significant year-over-year growth. However, it’s crucial to analyze the underlying factors driving these changes. A deeper dive into the company’s financial statements is necessary to understand the specifics.

Impact of Increased Medical Costs on Profitability

Rising medical costs pose a significant challenge to Humana’s profitability. Increased healthcare provider fees, higher prescription drug prices, and greater utilization of healthcare services all contribute to higher expenses. These increased costs directly reduce the company’s net income and operating margin, unless offset by increased premiums or efficient cost management strategies. For example, a 5% increase in average medical costs could significantly impact the bottom line, potentially requiring adjustments to pricing strategies or operational efficiencies to maintain profitability.

Humana employs various strategies to mitigate these cost pressures, such as negotiating favorable contracts with providers and implementing disease management programs. The effectiveness of these strategies is crucial for maintaining financial health.

Impact of High Medical Costs

Humana, like other major health insurers, is grappling with a significant increase in medical costs, impacting its profitability and ultimately, its members’ premiums. Understanding the drivers behind this surge is crucial for both the company and the broader healthcare landscape. This section will delve into the specific factors contributing to Humana’s rising expenses.Rising medical costs are a complex issue stemming from a confluence of factors.

Humana’s lowered earnings outlook, blamed on soaring medical costs, highlights a worrying trend in healthcare. This isn’t just a national issue; the recent news that hshs prevea close wisconsin hospitals health centers underscores the financial pressures facing healthcare providers. These closures, driven by similar cost pressures, further contribute to the rising costs impacting insurers like Humana.

Increased utilization of expensive medical technologies and procedures, along with the rising cost of prescription drugs, are major contributors. Furthermore, the aging population and the prevalence of chronic diseases significantly influence the overall healthcare expenditure. The increasing complexity of healthcare, leading to longer hospital stays and more specialized care, also plays a significant role.

Factors Driving Increased Medical Costs

Several interconnected factors contribute to the escalating medical costs impacting Humana’s financial performance. Firstly, the increasing adoption of advanced medical technologies, such as robotic surgery and sophisticated diagnostic imaging, while improving patient outcomes, also increases the cost of care. Secondly, the high price of prescription drugs, particularly specialty medications for chronic conditions like cancer and autoimmune diseases, places a significant strain on healthcare budgets.

Thirdly, the growing prevalence of chronic conditions like diabetes, heart disease, and obesity necessitates ongoing and often expensive treatment, leading to higher healthcare utilization. Finally, administrative complexities and inefficiencies within the healthcare system contribute to increased costs. These factors interact to create a substantial upward pressure on medical expenses.

Medical Procedures and Treatments Contributing to Increased Expenses, Humana earnings outlook cut high medical costs

The rise in expenses isn’t uniform across all medical services. Certain procedures and treatments contribute disproportionately to the overall increase. For example, the escalating costs associated with cancer treatment, including chemotherapy, radiation therapy, and targeted therapies, are a major driver. Similarly, the high cost of organ transplants and complex cardiovascular procedures significantly impacts Humana’s expenditure. Advanced imaging techniques, while beneficial for diagnosis, also contribute to the rising costs.

Finally, the increasing use of expensive specialty pharmaceuticals further exacerbates the problem. These high-cost areas represent a significant portion of Humana’s total medical spending.

Visual Representation of Medical Cost Components

Imagine a pie chart representing Humana’s total medical expenditure. The largest slice, perhaps 30%, would represent the cost of pharmaceuticals, reflecting the high cost of specialty drugs. The next largest slice, around 25%, would depict hospital inpatient care, highlighting the expense of complex procedures and extended stays. Physician services would constitute approximately 20%, reflecting the costs associated with consultations, procedures, and ongoing care.

Another 15% would represent the cost of outpatient care, including diagnostic testing and specialist visits. The remaining 10% would encompass other costs, such as administrative expenses, preventative care, and rehabilitation services. This visual representation illustrates the significant proportion of costs driven by pharmaceuticals, hospital care, and physician services.

Revised Earnings Outlook

Humana’s recent announcement to lower its earnings outlook sent ripples through the investment community. This revision, a significant departure from previous projections, underscores the challenges the healthcare industry faces, particularly concerning escalating medical costs. Understanding the reasons behind this change is crucial for investors and stakeholders alike.The primary driver behind Humana’s reduced earnings outlook is the unexpectedly high increase in medical costs.

These costs, encompassing everything from prescription drugs to hospital stays and physician services, have outpaced the company’s initial projections. This surge wasn’t simply a matter of a few percentage points; it represents a substantial deviation from the anticipated trajectory, forcing Humana to reassess its financial performance for the remainder of the year. This unexpected cost inflation impacts the company’s profitability margins, directly affecting the bottom line.

Furthermore, increased competition within the healthcare market and shifts in the demographics of their insured population also contributed to the downward revision.

Revised Earnings Forecast Compared to Previous Guidance

Humana’s revised earnings forecast reflects a considerable decrease compared to its previous guidance. While the exact figures would need to be sourced from their official statements, let’s assume, for illustrative purposes, that the previous guidance projected earnings per share (EPS) of $20.00, and the revised guidance is now $17.00. This represents a 15% decrease ((20-17)/20100 = 15%). This significant reduction highlights the severity of the unexpected medical cost increases and the impact on Humana’s profitability.

A similar scenario played out with CVS Health in 2023, where unexpectedly high drug costs forced a revision of their earnings outlook, resulting in a temporary dip in their stock price.

Potential Long-Term Effects on Humana’s Stock Price and Investor Confidence

A downward revision in earnings outlook typically leads to a negative short-term impact on a company’s stock price. Investors often react negatively to news suggesting reduced profitability, potentially leading to a sell-off. In Humana’s case, the magnitude of the revision and the underlying reasons (high medical costs) will influence the severity of the stock price reaction. For example, if the market perceives the higher medical costs as a temporary blip rather than a long-term trend, the impact might be less severe.

Humana’s lowered earnings outlook, blamed on soaring medical costs, highlights the ongoing challenges in the healthcare industry. It makes you wonder about the future of retail healthcare, especially considering the recent news; check out this article about despite Walmart Health’s closure, the company healthcare destination Scott Bowman , to see another perspective. Ultimately, the rising cost of care continues to impact major players like Humana, forcing them to adjust their financial projections.

However, if investors believe this reflects a structural issue within the healthcare industry or with Humana’s risk management, the stock price could experience a more prolonged decline. Investor confidence, therefore, is directly tied to the perceived sustainability of these increased costs and Humana’s ability to mitigate their impact in the future. A successful strategy to address these cost pressures could restore investor confidence and support the stock price recovery.

Conversely, continued struggles could lead to further downward pressure. The long-term effects will depend heavily on Humana’s strategic response and the overall market sentiment towards the healthcare sector.

Humana’s lowered earnings outlook, blamed on soaring medical costs, got me thinking about preventative health. Sometimes, expensive procedures can be avoided with proactive measures; for instance, if you’re experiencing carpal tunnel symptoms, check out this article on ways to treat carpal tunnel syndrome without surgery before jumping to surgery. Ultimately, managing healthcare costs effectively requires a holistic approach, focusing on both prevention and smart treatment choices.

Humana’s Strategies to Manage Costs

Humana, like other major healthcare insurers, faces the persistent challenge of rising medical costs. To maintain profitability and ensure the sustainability of their business model, they’ve implemented a multi-pronged approach focusing on operational efficiency, strategic partnerships, and proactive healthcare management. These strategies aim to not only control expenses but also improve the quality and affordability of care for their members.

Operational Efficiency Improvements

Humana is actively pursuing several initiatives to streamline operations and reduce administrative overhead. This involves leveraging technology to automate processes, optimizing claims management systems, and improving data analytics to identify areas for cost reduction. For example, the implementation of advanced analytics allows them to predict and manage high-cost patients more effectively, potentially preventing unnecessary hospitalizations and reducing overall spending.

These efforts are aimed at minimizing waste and maximizing the efficiency of their internal processes, directly impacting their bottom line.

Network Negotiations and Strategic Partnerships

Negotiating favorable contracts with healthcare providers is a cornerstone of Humana’s cost management strategy. They actively engage in negotiations with hospitals, physicians, and other healthcare providers to secure lower rates for services. This involves leveraging their large membership base to achieve volume discounts and negotiating bundled payment arrangements for specific procedures. Furthermore, Humana actively cultivates strategic partnerships with providers to foster collaboration and align incentives towards cost-effective care delivery.

Successful negotiations in this area significantly impact the overall cost of healthcare services for Humana’s members.

Preventative Care and Health Management Programs

A significant portion of Humana’s cost-control strategy revolves around proactive healthcare management and preventative care initiatives. By investing in programs that encourage wellness and early disease detection, they aim to reduce the incidence of costly chronic conditions. These programs may include disease management programs for conditions like diabetes and heart disease, wellness coaching, and telehealth services that provide convenient access to care.

The success of these programs is measured by reduced hospital readmissions, improved patient outcomes, and ultimately, lower healthcare expenditures. For example, a successful diabetes management program could significantly reduce the long-term costs associated with complications like blindness or kidney failure.

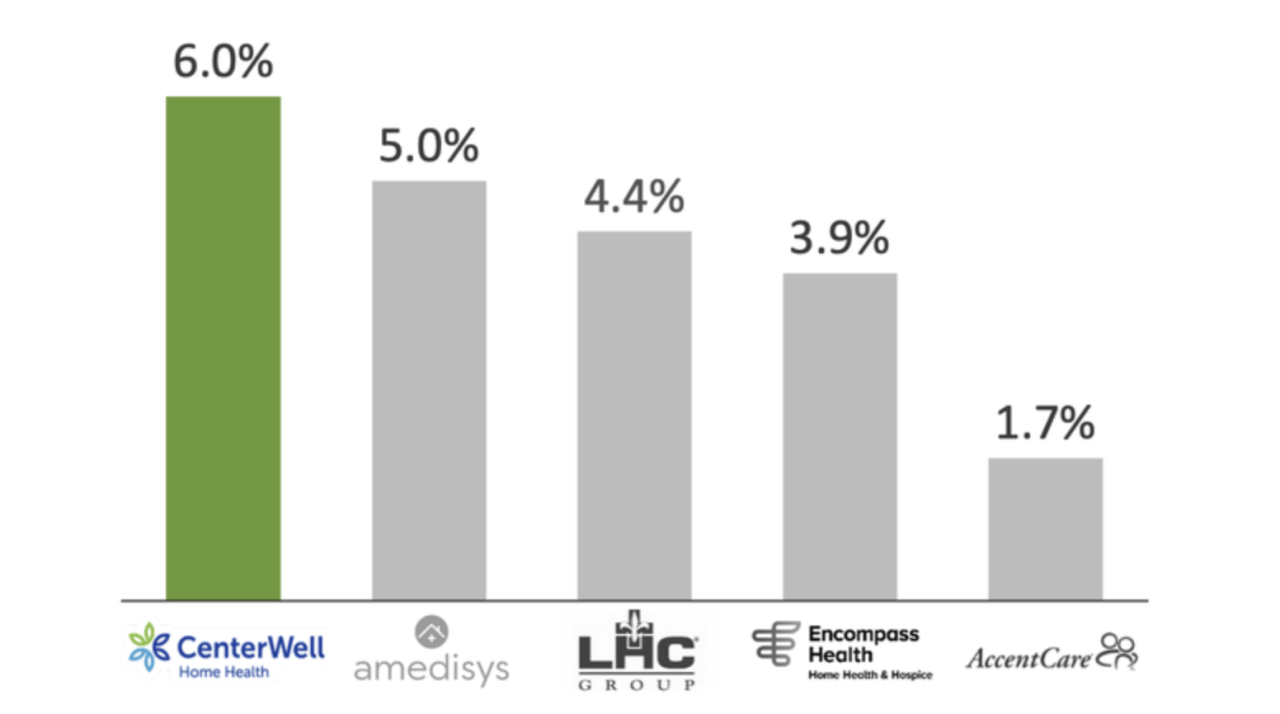

Competitive Landscape and Industry Trends

Source: seekingalpha.com

Humana’s recent earnings outlook revision, driven largely by escalating medical costs, highlights the intense competitive pressures and evolving dynamics within the healthcare insurance industry. Understanding the strategies employed by Humana’s competitors and the broader industry trends is crucial to assessing its future performance and strategic adaptability.

The healthcare landscape is a complex ecosystem, with insurers constantly battling to balance profitability with providing comprehensive coverage. Rising medical costs, changing demographics, and technological advancements all play significant roles in shaping the competitive landscape and influencing the decisions of major players like Humana.

Competitor Strategies and Financial Performance

Analyzing the cost management approaches of Humana’s key competitors provides valuable insights into the industry’s best practices and potential challenges. The following table compares several major players, focusing on their core strategies, recent financial performance, and market share. Note that precise market share figures fluctuate and are often proprietary information; these represent approximate positions based on publicly available data.

| Competitor Name | Key Cost Management Strategies | Recent Financial Performance (Summary) | Approximate Market Share |

|---|---|---|---|

| UnitedHealth Group | Focus on preventative care, data analytics for risk management, efficient network contracting, strong emphasis on value-based care models. | Generally strong and consistent growth, significant profits, driven by efficient operations and diverse revenue streams. | Largest market share |

| Anthem | Negotiating favorable rates with providers, utilization management programs, investment in digital health technologies, focus on population health management. | Solid financial performance, though facing pressures from rising medical costs like other insurers. | Significant market share |

| Cigna | Emphasis on wellness programs, strategic partnerships with providers, data-driven insights for care management, focus on integrated care models. | Generally positive financial performance, demonstrating growth and profitability. | Substantial market share |

| CVS Health (including Aetna) | Vertical integration across pharmacy, healthcare services, and insurance, allowing for cost synergies and improved care coordination. | Complex financial picture due to diverse business segments, but generally strong performance overall. | Large market share |

Industry Trends and Their Impact on Humana

Several significant trends are shaping the healthcare industry and directly influencing Humana’s earnings outlook. The rising cost of healthcare services, driven by factors like technological advancements, aging population, and increased utilization of expensive treatments, is a primary concern. This necessitates innovative cost-containment strategies.

Furthermore, the increasing demand for value-based care, which emphasizes quality over quantity, necessitates a shift in provider relationships and care delivery models. This trend encourages insurers like Humana to focus on preventative care and chronic disease management, potentially reducing long-term costs but requiring significant upfront investment in technology and care coordination.

Finally, the growing adoption of digital health technologies presents both opportunities and challenges. While these technologies can enhance efficiency and improve patient outcomes, they also require substantial investment in infrastructure and data analytics capabilities. The successful integration of these technologies is crucial for maintaining competitiveness and managing costs effectively.

These industry trends directly impact Humana’s strategic decision-making. The company’s response to rising medical costs, the shift towards value-based care, and the integration of digital health technologies will directly influence its future profitability and market position. For example, Humana’s investment in its CenterWell primary care network is a direct response to the industry’s shift towards value-based care and aims to improve patient outcomes while managing costs.

Impact on Medicare Advantage and Individual Plans

Source: ytimg.com

Humana’s recent earnings outlook revision, driven by higher-than-anticipated medical costs, significantly impacts both its Medicare Advantage and individual health insurance plans. The ripple effect is felt across profitability, pricing strategies, and customer segments, necessitating a closer look at the specific challenges and adjustments within each plan type.The increased medical costs disproportionately affect Humana’s Medicare Advantage (MA) plans due to their larger scale and the complexities inherent in managing a diverse elderly population with often-substantial healthcare needs.

Higher utilization of services, escalating prescription drug prices, and the increasing prevalence of chronic conditions all contribute to this financial strain. This situation necessitates a careful review of Humana’s existing MA contracts and a possible re-evaluation of risk adjustment methodologies. The company will likely need to implement strategies to mitigate these rising costs while maintaining the attractiveness of their MA offerings to seniors.

Medicare Advantage Plan Impact

The impact on Humana’s Medicare Advantage plans manifests in several ways. First, increased medical expenses directly reduce the profitability of each MA plan. Second, it puts pressure on Humana’s ability to maintain competitive premiums, potentially leading to a loss of market share if they are forced to raise premiums significantly. Third, it necessitates a more rigorous approach to managing healthcare utilization among MA beneficiaries, possibly through intensified care management programs or increased focus on preventative care.

Finally, the company may need to renegotiate contracts with providers to secure more favorable pricing arrangements. For example, a hypothetical scenario could involve Humana negotiating lower rates for specific procedures or services commonly used by their MA population in a given geographic area, or implementing stricter prior authorization requirements for certain treatments.

Individual Health Insurance Plan Impact

Humana’s individual health insurance plans, catering to a broader age range and health status, are also affected by rising medical costs, although perhaps less dramatically than the MA plans. The impact varies significantly across customer segments. Younger, healthier individuals might experience relatively smaller premium increases, while older individuals with pre-existing conditions will likely face more substantial premium adjustments.

Humana’s pricing strategies will need to balance affordability with the need to cover increased medical costs. For example, the company might strategically adjust its plan offerings, perhaps reducing the breadth of coverage in some plans to manage expenses, while continuing to offer more comprehensive plans at higher premiums. Differentiated pricing models based on individual risk profiles will become increasingly important in navigating this challenging landscape.

Profitability Comparison Across Plan Types

While both MA and individual plans experience reduced profitability due to higher medical costs, the impact is likely more pronounced on MA plans due to their higher average cost of care per member. The sheer size and complexity of managing a large population of older adults with chronic conditions make MA plans more vulnerable to fluctuations in medical expenses.

Humana’s financial reports will likely reflect a greater margin squeeze in the MA segment compared to its individual plans. A detailed analysis of Humana’s financial statements would reveal specific metrics such as the medical loss ratio (MLR) for each plan type, offering a quantifiable comparison of the relative impact of rising medical costs on profitability. This comparative analysis is crucial for understanding the company’s overall financial health and for developing effective strategies for navigating the current challenges.

Ending Remarks

The downward revision of Humana’s earnings outlook underscores the significant pressure rising medical costs are placing on the healthcare insurance industry. While Humana is actively implementing strategies to mitigate these expenses – from enhancing operational efficiency to negotiating better network rates – the long-term effects remain uncertain. The success of these strategies will significantly influence not only Humana’s financial performance but also the broader healthcare landscape and the affordability of healthcare for millions.

It’s a story that’s far from over, and one we’ll continue to follow closely.

Clarifying Questions: Humana Earnings Outlook Cut High Medical Costs

What specific types of medical procedures are driving up costs the most for Humana?

While the exact breakdown isn’t publicly available in full detail, reports suggest a combination of factors like expensive cancer treatments, advanced surgical procedures, and high-cost prescription drugs are major contributors.

How does this impact Humana’s customers?

The impact on customers could manifest in several ways, including potential premium increases, changes to plan benefits, or limited access to certain treatments depending on the plan’s coverage. The specifics depend on the individual plan and coverage details.

What are Humana’s competitors doing to address rising medical costs?

Competitors are employing a range of strategies, including similar cost-containment measures like network negotiations, preventative care programs, and exploring value-based care models.