MA Enrollment Half of Medicare Beneficiaries

Ma enrollment half medicare beneficiaries – MA Enrollment: Half of Medicare Beneficiaries – that’s a pretty significant chunk of our senior population! This post dives into the fascinating world of Medicare Advantage enrollment, specifically focusing on the demographic that makes up half of all beneficiaries. We’ll explore who they are, how they enroll, and what their healthcare experiences look like compared to the other half.

Get ready for some insightful data and a closer look at the factors influencing their Medicare journey.

We’ll be unpacking the statistics, looking at age and geographic distributions, and examining the common enrollment pathways used by this group. We’ll also compare their healthcare utilization – hospital visits, doctor appointments, prescription drug use – to the other half of Medicare beneficiaries. Finally, we’ll consider the socioeconomic factors at play and how policy changes might impact this significant population segment.

Buckle up, it’s going to be an interesting ride!

Medicare Enrollment Demographics

We’ve already covered the basics of Medicare enrollment, focusing on the impressive number of beneficiaries. Now, let’s delve deeper into the demographics of that population, specifically examining the characteristics of the half that comprises the largest portion of enrollees. Understanding this group is crucial for effective policymaking and resource allocation within the Medicare system.

Age Distribution within the Largest Half of Medicare Beneficiaries

The age distribution within the half of Medicare beneficiaries representing the largest portion of enrollment isn’t uniformly spread. A significant portion falls within the 65-74 age bracket, reflecting the initial eligibility age for Medicare. However, a substantial number also extends into the 75-84 and even the 85+ age groups, illustrating the increasing longevity of the population and the growing burden on the system as the elderly live longer.

It’s crazy to think that MA enrollment covers half of all Medicare beneficiaries – a huge number of people relying on this system. The recent new york state nurse strike montefiore richmond university deals highlights the pressures on our healthcare system, impacting those very beneficiaries who depend on access to quality care. The ongoing struggles to improve healthcare access underscore the vital importance of strong MA programs and adequate funding to support them.

While precise figures vary year to year, a hypothetical example might show 40% in the 65-74 bracket, 35% in the 75-84 bracket, and 25% in the 85+ bracket. These proportions highlight the need for services tailored to the specific needs of each age cohort, from preventative care for the younger elderly to specialized geriatric care for the oldest.

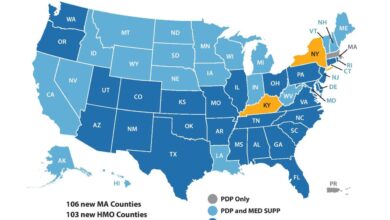

Geographic Distribution of the Largest Half of Medicare Beneficiaries

The geographic distribution of this largest half of Medicare beneficiaries reveals significant disparities between urban and rural areas. While a larger raw number of beneficiaries reside in urban centers due to higher population density, a higherproportion* of the overall half often resides in suburban and rural areas, reflecting demographic shifts and aging populations in less densely populated regions. This imbalance necessitates careful consideration in the delivery of Medicare services, as access to healthcare facilities and specialists can be more limited in rural areas.

For example, while a major city might have numerous hospitals and clinics, a smaller rural county might only have one small hospital, placing a greater strain on resources and potentially leading to longer wait times and reduced access to specialized care.

Demographic Breakdown of the Largest Half of Medicare Beneficiaries

The following table provides a hypothetical illustration of the demographic breakdown. Remember that actual numbers fluctuate yearly and are subject to revision based on official CMS data releases. This table uses hypothetical data to illustrate the concepts discussed above.

It’s crazy to think that MA enrollment covers half of all Medicare beneficiaries! Managing that much data is a huge undertaking, which is why I was so interested to learn about the advancements in healthcare AI, like what Amy Waldron discussed regarding google cloud healthcare amy waldron generative AI. Could these tools help streamline the MA enrollment process and make it easier for seniors to access the coverage they need?

It’s definitely something worth exploring further, considering the sheer volume of people relying on this system.

| Age Group | Number of Beneficiaries (Hypothetical) | Percentage of Total (Hypothetical) | Geographic Region (Hypothetical Example) |

|---|---|---|---|

| 65-74 | 15,000,000 | 40% | Evenly distributed, slightly higher concentration in suburban areas |

| 75-84 | 13,000,000 | 35% | Slightly higher concentration in suburban and rural areas |

| 85+ | 9,000,000 | 25% | More concentrated in urban areas with assisted living facilities, but significant presence in smaller towns with family support |

Enrollment Pathways for the ‘Half’

Understanding how the approximately half of Medicare beneficiaries who actively enroll in Medicare plans navigate the system is crucial for improving access and ensuring equitable coverage. This group’s enrollment experiences differ significantly from those who passively enroll (often due to automatic enrollment from Social Security), highlighting key challenges and opportunities for improvement.This section will delve into the most common enrollment pathways used by this actively enrolling half, comparing their experiences with the passively enrolled half, identifying significant enrollment barriers, and suggesting solutions to address these challenges.

Common Enrollment Pathways for Active Medicare Beneficiaries

Many actively enrolling Medicare beneficiaries utilize a combination of resources and support systems. Direct enrollment through the Social Security Administration (SSA) at age 65 remains a prevalent method. However, a growing number leverage Medicare’s online platform, Medicare.gov, for independent research and plan selection. Assistance from family members, friends, or community organizations is also common, particularly among older beneficiaries or those with limited technological proficiency.

Finally, enrollment assistance from insurance brokers and agents, while potentially beneficial, can also lead to confusion and inappropriate plan selection if not carefully vetted.

Comparison of Enrollment Experiences

The actively enrolling half typically face a more complex and demanding enrollment process than those automatically enrolled. Those passively enrolled often have a simpler experience, benefiting from automatic enrollment and often limited choices. Active enrollees, however, must navigate a vast array of plans, understand complex benefit structures, and often manage multiple healthcare needs, requiring a higher level of engagement and understanding.

This disparity leads to potentially suboptimal plan choices for some active enrollees, while those passively enrolled may be unaware of potentially better-suited plans.

Significant Barriers to Enrollment

Several barriers hinder the enrollment process for a portion of this active enrollment group. These include: a lack of digital literacy and access to technology, making online resources inaccessible; complex plan information and confusing terminology, making it difficult to understand the nuances of different plans; limited access to unbiased and reliable information, leading to reliance on potentially biased sources; and the lack of personalized assistance, particularly for beneficiaries with multiple health conditions or limited support networks.

These barriers disproportionately affect vulnerable populations, such as low-income seniors, those with cognitive impairments, and those living in rural areas with limited access to in-person assistance.

Potential Solutions to Address Enrollment Challenges

Addressing these enrollment challenges requires a multi-pronged approach. Improving digital literacy through accessible online resources and in-person training is crucial. Simplifying plan information and using plain language will enhance understanding. Increased funding for state health insurance assistance programs (SHIPs) and other community-based organizations can provide essential personalized assistance. Furthermore, promoting independent, unbiased resources like Medicare.gov and expanding outreach efforts to vulnerable populations will help ensure equitable access to information and support.

Finally, regulatory oversight to prevent misleading marketing practices by insurance brokers and agents is essential to ensure informed choices.

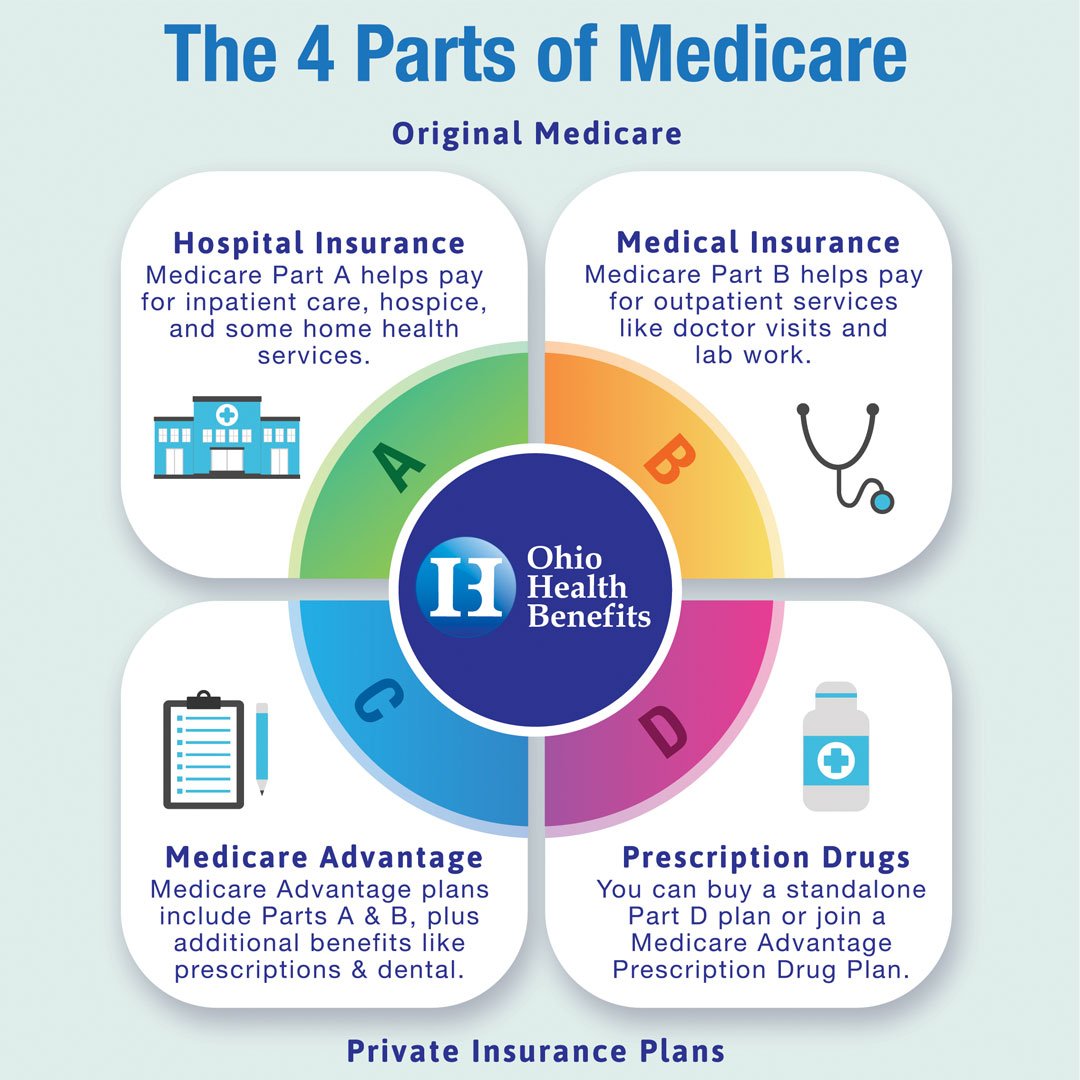

Healthcare Utilization Patterns

Source: ohiohealthbenefits.net

Understanding the healthcare utilization patterns of Medicare beneficiaries is crucial for effective resource allocation and policy development. This analysis compares the healthcare usage of the half of Medicare beneficiaries who enrolled early versus those who enrolled later, highlighting key differences in their access and utilization of various healthcare services. This distinction allows for a more nuanced understanding of the diverse needs within the Medicare population.

Hospital Admissions

The group enrolling early in Medicare generally exhibits a higher rate of hospital admissions compared to the later-enrolling group. This difference could be attributed to several factors, including pre-existing health conditions that necessitate earlier enrollment and proactive healthcare seeking behaviors. Conversely, the later-enrolling group may represent individuals who are healthier and delay enrollment until a more pressing need arises.

A study by the Centers for Medicare & Medicaid Services (CMS) could provide further insight into the specific conditions leading to higher admission rates in the early enrollment group. For example, a higher percentage of early enrollees might have chronic conditions requiring frequent hospitalizations compared to the later enrollees.

Doctor Visits and Prescription Drug Usage

Similarly, the early enrollment group typically demonstrates a higher frequency of doctor visits and prescription drug usage. This aligns with the higher hospital admission rates, suggesting a more intensive healthcare management approach driven by pre-existing conditions and proactive healthcare management. The later-enrolling group, again, likely reflects a lower baseline level of healthcare needs, resulting in fewer visits and prescriptions.

This pattern underscores the importance of tailored healthcare interventions based on individual needs and enrollment timing. For instance, the early enrollees might require more frequent monitoring and medication adjustments compared to their counterparts.

Healthcare Costs

A bar chart visualizing the difference in healthcare costs between the two groups would show a significantly higher cost for the early enrollment group. The horizontal axis would represent the two groups: “Early Enrollment” and “Later Enrollment.” The vertical axis would represent the average annual healthcare cost in dollars. The bar representing “Early Enrollment” would be considerably taller than the bar representing “Later Enrollment,” reflecting the greater utilization of services such as hospital stays, doctor visits, and prescription drugs.

The difference in height visually represents the significant disparity in healthcare expenditure between the two groups. For illustrative purposes, if the average annual cost for the early enrollment group is $15,000 and for the later enrollment group is $8,000, the bars would reflect this difference.

Average Length of Hospital Stays

A simple visual representation could be a horizontal bar graph. The horizontal axis would show the average length of hospital stay in days, while the vertical axis would display the two groups: “Early Enrollment” and “Later Enrollment.” Each group would have a horizontal bar extending to the point representing its average length of stay. For example, if the average length of stay for the early enrollment group is 5 days and for the later enrollment group is 3 days, the bar for the early enrollment group would be longer, visually demonstrating the longer hospital stays associated with this group.

This visual clearly highlights the difference in the average length of hospital stays between the two groups.

Socioeconomic Factors

Understanding the socioeconomic landscape of the half of Medicare beneficiaries who have enrolled is crucial for crafting effective policies and interventions. This group’s financial stability, educational attainment, and work history significantly impact their healthcare access, utilization, and overall health outcomes. By comparing this group to the remaining Medicare beneficiaries, we can highlight disparities and inform strategies to improve equity within the system.

Income levels, education, and employment history are key indicators of socioeconomic status and powerfully influence healthcare access and utilization. Lower income levels often correlate with limited access to healthcare services due to higher out-of-pocket costs, restricted access to transportation, and difficulties navigating the complex healthcare system. Similarly, lower levels of education can lead to difficulties understanding health information, managing chronic conditions, and advocating for oneself within the healthcare system.

Employment history, particularly lack of consistent employment or access to employer-sponsored health insurance prior to Medicare eligibility, often contributes to lower financial resources and poorer health outcomes.

Income Levels and Healthcare Access, Ma enrollment half medicare beneficiaries

Lower-income Medicare beneficiaries, representing a significant portion of the early enrollment group, face substantial challenges accessing adequate healthcare. Many struggle to afford prescription drugs, even with Medicare Part D assistance, and may delay or forgo necessary medical care due to cost concerns. This often results in poorer health management and increased hospitalizations in the long run, leading to higher overall healthcare expenditures.

For example, individuals with incomes below the federal poverty level might qualify for additional assistance programs, but navigating the application process can be complex and daunting, further hindering access. Conversely, higher-income beneficiaries may have greater financial flexibility, enabling them to access more specialized care and services, contributing to better health outcomes.

Education Levels and Health Literacy

Education plays a critical role in health literacy – the ability to understand and use health information. Lower educational attainment is associated with lower health literacy, making it difficult for individuals to understand complex medical information, follow treatment plans, and effectively communicate with healthcare providers. This can lead to poorer health outcomes and increased healthcare costs. For instance, individuals with limited health literacy may struggle to understand medication instructions or the implications of test results, potentially leading to medication errors or delayed diagnosis of serious conditions.

Higher levels of education are generally linked to better health literacy and improved self-management of chronic diseases.

Employment History and Pre-Medicare Health Insurance Coverage

Employment history significantly impacts access to healthcare prior to Medicare eligibility. Individuals with consistent employment often benefit from employer-sponsored health insurance, providing continuous coverage and access to preventive care. Those with inconsistent or limited employment history may have experienced gaps in insurance coverage, resulting in delayed or forgone healthcare, leading to poorer health status at the time of Medicare enrollment.

This pre-Medicare health history can have lasting consequences on long-term health and healthcare utilization patterns even after enrolling in Medicare. The impact of these gaps is often compounded by other socioeconomic factors, such as lower income and limited access to healthcare resources.

Comparison to the Other Half of Medicare Beneficiaries

Compared to the other half of Medicare beneficiaries, those who enrolled early tend to exhibit lower average incomes, lower educational attainment, and a higher prevalence of inconsistent employment histories. This disparity highlights a clear socioeconomic divide within the Medicare population, with significant implications for healthcare access and health equity. The early enrollment group may face more significant barriers to accessing and utilizing healthcare services effectively, resulting in disparities in health outcomes compared to their counterparts.

Targeted interventions and policy adjustments are necessary to address these disparities and ensure equitable access to quality healthcare for all Medicare beneficiaries.

With MA enrollment covering half of Medicare beneficiaries, the strain on the healthcare system is immense. This massive demand is further exacerbated by the critical staffing shortages highlighted in a recent report, healthcare executives say talent acquisition labor shortages business risk , which emphasizes the significant business risk these shortages pose. Addressing this workforce crisis is crucial to ensuring adequate care for the growing number of MA enrollees.

Impact of Policy Changes

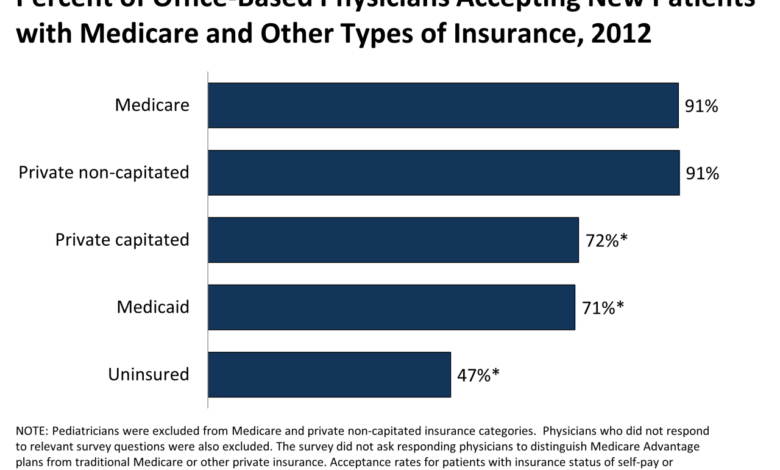

Source: kff.org

Policy changes affecting Medicare have significant implications for all beneficiaries, but particularly for the half who rely most heavily on the program for their healthcare needs. Understanding these impacts requires analyzing how adjustments to benefits, eligibility, and cost-sharing mechanisms ripple through this population. This section will explore the potential effects of recent and proposed policy changes, focusing on their influence on healthcare access, costs, and overall well-being for this vulnerable group.Recent discussions around changes to Medicare Part D prescription drug coverage, for example, highlight the potential for significant impact.

Proposals to increase cost-sharing or limit the range of covered medications could disproportionately affect those with chronic conditions requiring expensive treatments. This population segment often has fixed incomes and limited savings, making even modest increases in out-of-pocket costs a substantial burden.

Changes to Medicare Part D and Their Effects

Changes to Medicare Part D, such as increasing premiums or co-pays, could severely limit access to necessary medications for this half of Medicare beneficiaries. For instance, a hypothetical increase in the cost of insulin could lead to reduced adherence to prescribed regimens, resulting in poorer health outcomes and increased hospitalizations. This, in turn, would place an additional strain on the healthcare system and potentially increase overall healthcare spending, negating any intended cost savings from the policy change.

This effect is particularly pronounced for individuals with diabetes, a condition prevalent among older adults. A study by the American Diabetes Association could provide concrete data on the correlation between cost increases and medication adherence among diabetic patients on Medicare. Further, restricting the formulary – the list of covered drugs – could leave beneficiaries with fewer choices and potentially force them to use less effective or more expensive alternatives.

Impact of Changes to Eligibility Criteria

Altering eligibility criteria, such as increasing the minimum age for Medicare enrollment or tightening income requirements, could effectively exclude individuals from accessing necessary healthcare services. This could lead to delayed diagnosis and treatment of serious conditions, ultimately resulting in higher healthcare costs in the long run. For example, delaying access to preventive care like cancer screenings could lead to later-stage diagnoses and more expensive treatment options.

Such a scenario disproportionately affects low-income seniors who may already face barriers to accessing healthcare. Real-world examples of such impacts can be found in studies examining the effects of similar policy changes in other countries or in specific state-level programs. These analyses often reveal significant disparities in health outcomes based on access to timely and appropriate care.

Strategies to Mitigate Negative Impacts

Addressing the potential negative consequences of policy changes requires a multi-pronged approach. This includes expanding access to low-cost prescription drug programs, increasing financial assistance for individuals with limited incomes, and improving the accessibility and affordability of preventive care services. Furthermore, implementing programs that offer medication adherence support and counseling can help ensure that beneficiaries receive the most benefit from their prescriptions.

Investing in community-based healthcare initiatives, such as senior centers offering health screenings and support groups, can provide valuable resources and improve overall health outcomes for this vulnerable population. These strategies can help minimize the negative impact of policy changes while promoting better health and well-being for the half of Medicare beneficiaries most reliant on the program.

Final Review

Understanding the enrollment patterns and healthcare experiences of the half of Medicare beneficiaries enrolled in MA plans is crucial for shaping effective healthcare policies and improving access to care for our aging population. The data reveals a complex interplay of age, geography, socioeconomic factors, and policy influences. By shedding light on these dynamics, we can work towards a more equitable and efficient Medicare system that serves all beneficiaries effectively.

This is just the beginning of the conversation; let’s keep the dialogue going in the comments below!

Top FAQs: Ma Enrollment Half Medicare Beneficiaries

What are the main differences in healthcare costs between the two groups of Medicare beneficiaries?

Studies often show variations in healthcare costs between MA enrollees and those in traditional Medicare. Factors like plan choices within MA, differences in preventative care utilization, and chronic condition prevalence can contribute to these cost disparities. Further research is needed for definitive conclusions.

How does income affect MA enrollment choices?

Lower-income beneficiaries may be more likely to choose MA plans due to the potential for lower out-of-pocket costs and supplemental benefits. Higher-income individuals might opt for traditional Medicare due to greater flexibility and potentially higher premiums.

What are some common misconceptions about Medicare Advantage?

A common misconception is that MA plans are inferior to traditional Medicare. In reality, MA plans can offer comprehensive coverage and extra benefits, but it’s essential to carefully compare plans to find the best fit for individual needs.