Over Half Million Disenrolled KFF Medicaid Redeterminations

Over half million disenrolled Medicaid redeterminations KFF – Over half a million disenrolled Medicaid redeterminations, according to a recent KFF report, paints a stark picture of the challenges facing millions of Americans. This isn’t just a number; it represents families struggling to access essential healthcare, facing difficult choices, and navigating a complex system. This post dives into the KFF report’s findings, exploring the reasons behind these staggering disenrollment numbers and the impact on individuals and communities.

We’ll unpack the process of Medicaid redeterminations, examining the bureaucratic hurdles and administrative barriers that contribute to disenrollment. We’ll also analyze the disproportionate impact on specific demographic groups, highlighting the crucial need for policy changes to ensure equitable access to healthcare. Get ready for a deep dive into a critical issue impacting millions.

Medicaid Redeterminations

Source: creativecirclecdn.com

The unwinding of the continuous Medicaid enrollment provision, implemented during the COVID-19 public health emergency, has resulted in a massive wave of redeterminations across the United States. This process, where states reassess the eligibility of individuals enrolled in Medicaid, has led to significant disenrollments, impacting millions of Americans and raising serious concerns about access to healthcare. This post will delve into the scale of these disenrollments, focusing on the findings of a recent KFF report.

Medicaid Redetermination Process and Impact

Medicaid redetermination involves a rigorous process where states verify the continued eligibility of enrolled individuals based on factors such as income, household size, and citizenship status. Individuals are required to submit updated information, and failure to do so or changes in circumstances can lead to disenrollment. This process can be incredibly complex and burdensome for individuals, particularly those facing language barriers, limited access to technology, or other socioeconomic challenges.

The impact of disenrollment extends beyond the loss of healthcare coverage; it can lead to delayed or forgone medical care, increased medical debt, and ultimately, poorer health outcomes for individuals and families. The consequences are particularly severe for vulnerable populations, including children, pregnant women, and individuals with disabilities.

The KFF report on over half a million Medicaid disenrollments is sobering, highlighting the challenges in healthcare access. This makes the news about nuance integrating generative AI scribe with Epic EHRs even more crucial. Streamlining administrative tasks with AI could free up vital resources to support those newly navigating the complexities of healthcare coverage, potentially mitigating the impact of these Medicaid redeterminations.

KFF Report Findings on Disenrollments

The Kaiser Family Foundation (KFF) recently published a report detailing the significant number of Medicaid disenrollments following the end of the continuous coverage provision. The report highlights that over half a million individuals have already been disenrolled across numerous states, a number that is expected to rise considerably as the redetermination process continues. The KFF analysis underscores the uneven distribution of these disenrollments, with some states experiencing far higher rates than others.

This disparity reflects variations in state-level implementation of the redetermination process, including differences in outreach efforts, technological infrastructure, and the complexity of their eligibility systems. The report also emphasizes the disproportionate impact on specific demographic groups, further highlighting existing inequalities in healthcare access.

Over half a million people have lost Medicaid coverage, according to recent KFF reports on redeterminations. This massive shift impacts access to care, especially in rural areas, where services are already stretched thin. The challenges are amplified by the struggles faced by rural hospitals, many of which are already grappling with staffing shortages, as highlighted in this insightful article on Rural Hospitals Labor Delivery & This further complicates the situation for those newly disenrolled from Medicaid, leaving many vulnerable and without access to essential services.

The implications of these combined issues are significant and deserve careful consideration.

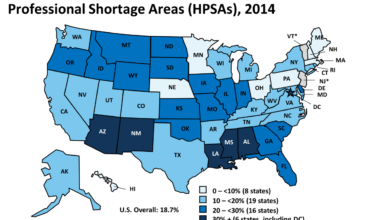

Geographic Distribution of Disenrollments

The KFF report provides a state-by-state breakdown of Medicaid disenrollments, revealing significant geographic variations. While precise figures vary depending on the reporting period and data availability, some states have reported substantially higher numbers of disenrollments than others. For example, states with less robust outreach programs or more complex application processes often show higher rates of disenrollment. Conversely, states with proactive outreach initiatives and streamlined systems tend to exhibit lower rates.

This geographic disparity underscores the critical need for targeted interventions and resource allocation to support states facing the greatest challenges in managing the redetermination process effectively.

Key Data Points from the KFF Report

| State | Number of Disenrollments | Demographics Affected | Potential Causes |

|---|---|---|---|

| Texas | 100,000+ (estimated) | Disproportionately affecting Latino and low-income families | Limited outreach, complex application process, language barriers |

| Florida | 75,000+ (estimated) | High rates among children and elderly | Technological challenges, bureaucratic hurdles, lack of awareness |

| California | 50,000+ (estimated) | Significant impact on undocumented immigrants and those with disabilities | Incomplete applications, failure to respond to renewal requests |

| Arizona | 25,000+ (estimated) | High rates among low-income families and individuals with mental health conditions | Limited access to technology, administrative delays |

Factors Contributing to Disenrollment

The recent KFF report on Medicaid redeterminations reveals a staggering number of disenrollments, exceeding half a million. Understanding the reasons behind these losses is crucial to improving the system and ensuring access to vital healthcare for vulnerable populations. This analysis delves into the multifaceted factors contributing to this alarming trend, exploring administrative barriers, demographic disparities, and systemic issues within the process.

Administrative Barriers and Bureaucratic Hurdles

Navigating the Medicaid renewal process can be incredibly complex, presenting significant challenges for many individuals. The sheer volume of paperwork, coupled with confusing instructions and stringent deadlines, often acts as an insurmountable barrier. Many individuals lack reliable internet access or the digital literacy skills necessary to complete online applications, further exacerbating the problem. In addition, inconsistent communication from state agencies, long wait times for phone assistance, and a lack of clear, accessible information contribute to a high rate of failed renewals.

The KFF report on over half a million Medicaid disenrollments is seriously concerning. It highlights the urgent need for better healthcare access solutions, and I was struck by a recent study widespread digital twins healthcare which suggests a potential path forward. Could personalized digital twins improve care coordination and reduce the impact of these kinds of disruptions to coverage?

The KFF numbers really underscore how crucial finding innovative solutions like this is.

The complexity of the process disproportionately affects those already struggling with poverty, lack of education, or limited English proficiency. For example, a single mother working multiple minimum-wage jobs may simply not have the time or resources to dedicate to filling out complicated forms, even if she understands the process.

Demographic Disparities in Disenrollment

The impact of Medicaid disenrollment is not evenly distributed across all demographic groups. KFF data likely shows disparities based on race, ethnicity, and age. Minority populations, particularly those with limited English proficiency, often face additional barriers due to language access issues and cultural misunderstandings. Older adults, who may have cognitive impairments or rely on others for assistance, are also particularly vulnerable.

For instance, a study might illustrate a higher disenrollment rate among Hispanic individuals compared to non-Hispanic white individuals, attributable to language barriers and a lack of culturally competent outreach efforts. Similarly, elderly individuals living alone, with limited technological skills, and lacking a strong support network may be more likely to be disenrolled due to their inability to navigate the complex renewal process.

Systemic Issues Contributing to High Disenrollment Numbers

The high number of Medicaid disenrollments reflects deeper systemic issues within the program.

- Inadequate outreach and communication: Many individuals are unaware of the renewal process or the deadlines involved.

- Complex application process: The paperwork and requirements are often overly burdensome and difficult to understand.

- Lack of accessible support services: Limited assistance is available to help individuals navigate the process.

- Insufficient funding for state agencies: Understaffed and under-resourced agencies struggle to process applications efficiently.

- Digital divide: Many individuals lack the internet access or digital literacy skills needed to complete online applications.

- Insufficient translation services: Language barriers prevent many individuals from fully understanding the process.

Impact on Healthcare Access and Outcomes

The recent surge in Medicaid redeterminations, resulting in over half a million disenrollments, has significant implications for healthcare access and overall health outcomes. Losing Medicaid coverage can create a cascade of negative effects for individuals and families, impacting their ability to afford and access necessary medical care, potentially leading to worsening health conditions and increased healthcare costs in the long run.

This section explores these potential consequences in detail.

The loss of Medicaid coverage directly translates to reduced access to healthcare services. For many, Medicaid is the primary source of healthcare financing, covering routine checkups, preventative care, and treatment for chronic conditions. Without this coverage, individuals may delay or forgo necessary medical care due to financial constraints, leading to preventable hospitalizations and worsening health outcomes. This is particularly true for individuals with pre-existing conditions or those managing chronic illnesses requiring ongoing medication and treatment.

Consequences of Medicaid Disenrollment for Individuals and Families

The consequences of losing Medicaid can be devastating for individuals and families. Imagine a single mother with two children, relying on Medicaid for their healthcare needs. Suddenly losing this coverage means she must now navigate the complexities of finding affordable healthcare options, potentially facing high out-of-pocket costs for doctor visits, prescriptions, and hospitalizations. This financial burden can force families to make difficult choices, such as choosing between paying for rent or medication, ultimately impacting their overall well-being and financial stability.

This scenario is unfortunately playing out for countless families across the country.

Implications for Healthcare Access, Affordability, and Health Outcomes

The impact extends beyond individual families to the broader healthcare system. Reduced access to preventative care can lead to an increase in more serious and costly health problems down the line. For example, delaying necessary screenings for cancer or diabetes can result in late-stage diagnoses and more expensive, extensive treatments. Similarly, individuals without access to mental health services may experience worsening mental health conditions, potentially leading to increased hospitalizations and emergency room visits.

The affordability of healthcare becomes a significant barrier, pushing individuals to delay or forgo essential care, ultimately leading to poorer health outcomes and higher overall healthcare expenditures in the long run.

Examples of Impact on Individuals’ Health and Well-being, Over half million disenrolled Medicaid redeterminations KFF

Let’s consider a few concrete examples. A diabetic individual who loses Medicaid coverage might struggle to afford their insulin, leading to uncontrolled blood sugar levels, potentially resulting in serious complications like blindness or kidney failure. Similarly, an individual with a chronic heart condition might forgo necessary medication due to cost, increasing their risk of heart attack or stroke.

A child with asthma might miss crucial follow-up appointments with their pulmonologist, leading to more frequent and severe asthma attacks. These are not hypothetical scenarios; these are the real-life consequences faced by individuals losing their Medicaid coverage.

Potential Long-Term Effects on the Overall Healthcare System

The long-term effects of widespread Medicaid disenrollment are far-reaching and pose significant challenges to the healthcare system. These effects are not just felt by individuals but ripple through the entire system.

- Increased hospital readmissions: Delayed or forgone care leads to more severe health problems requiring hospitalization, resulting in higher healthcare costs and increased strain on hospital resources.

- Higher emergency room utilization: Individuals without regular healthcare access often rely on emergency rooms for care, which is a more expensive and less efficient approach to healthcare delivery.

- Increased mortality rates: Lack of access to preventative care and treatment can lead to preventable deaths, particularly among vulnerable populations.

- Strain on public health resources: Increased rates of preventable illnesses put a greater burden on public health initiatives aimed at disease prevention and control.

- Increased healthcare costs: The delayed and inadequate care resulting from Medicaid disenrollment often leads to more expensive treatments later on, ultimately increasing the overall healthcare costs for the system.

Policy Implications and Potential Solutions: Over Half Million Disenrolled Medicaid Redeterminations KFF

Source: txinsight.com

The massive disenrollment from Medicaid following the end of the continuous coverage requirement highlights critical policy failures and their disproportionate impact on vulnerable populations. Understanding these implications and implementing effective solutions is crucial to ensuring equitable access to healthcare and preventing negative health outcomes. The sheer scale of the problem demands a multifaceted approach, combining procedural improvements with broader policy reforms.

Policy Implications for Health Equity

High disenrollment rates exacerbate existing health inequities. Individuals from marginalized communities – including people of color, those with disabilities, and those living in rural areas – often face systemic barriers to navigating the complex Medicaid redetermination process. These barriers include limited access to technology, language barriers, and lack of awareness about the process itself. Consequently, these populations experience disproportionately higher disenrollment rates, leading to reduced access to preventive care, delayed treatment for chronic conditions, and ultimately, poorer health outcomes.

This creates a vicious cycle where those most in need are the least likely to maintain their coverage, widening existing health disparities. For example, studies have shown that Black and Hispanic individuals are significantly more likely to lose Medicaid coverage than their white counterparts, even when controlling for other factors.

Improving the Medicaid Redetermination Process

Several strategies can improve the redetermination process and minimize disruptions. Streamlining the application process through user-friendly online portals and multilingual support can significantly improve accessibility. Proactive outreach programs, including personalized reminders and assistance with completing forms, can ensure individuals are aware of deadlines and have the support they need. Expanding eligibility assistance programs and partnering with community organizations to provide in-person support can further enhance access for vulnerable populations.

States could also explore options such as extending the grace period for renewals, allowing for automatic renewal in certain cases, and simplifying the documentation requirements. Robust quality control mechanisms should be implemented to ensure accuracy and minimize errors in the redetermination process.

Successful State Strategies

Some states have successfully implemented innovative strategies to improve their Medicaid redetermination processes. For instance, California invested heavily in outreach and enrollment assistance programs, resulting in significantly lower disenrollment rates compared to the national average. They used a multi-pronged approach that included text message reminders, multilingual call centers, and partnerships with community-based organizations. Similarly, Washington state utilized a risk-based approach, prioritizing outreach efforts to individuals identified as being at high risk of disenrollment.

This targeted approach allowed them to maximize the impact of their resources. These examples demonstrate the effectiveness of proactive, multi-faceted approaches that address both systemic and individual barriers.

Comparison of Policy Options

| Policy Option | Potential Effectiveness | Impact on Different Groups |

|---|---|---|

| Simplified Application Process | High – reduces administrative burden and improves accessibility | Positive impact across all groups, particularly beneficial for those with limited literacy or technological skills. |

| Increased Outreach and Assistance | High – ensures individuals are aware of deadlines and have support | Significant positive impact on vulnerable populations, such as the elderly, people with disabilities, and those with language barriers. |

| Extended Grace Period | Moderate – reduces immediate disenrollment but may not address underlying issues | Provides temporary relief for all groups, but may not be sufficient for those facing significant barriers to re-enrollment. |

| Automatic Renewal for Certain Groups | High – eliminates administrative burden for low-risk individuals | Positive impact for stable populations, but may not be appropriate for all groups. Requires careful risk assessment. |

Visual Representation of Key Findings

Data visualization is crucial for understanding the massive scale and complex nature of the Medicaid redeterminations. Two key charts – a bar chart and a pie chart – can effectively illustrate the distribution of disenrollments and the demographic breakdown of those affected. These visualizations offer a clear and concise way to grasp the key findings and their implications.The sheer volume of disenrollments necessitates a clear and easily digestible visual representation to understand the geographical distribution and the demographic impact.

State-Level Disenrollment Distribution

A bar chart effectively displays the number of Medicaid disenrollments across different states. The horizontal axis (x-axis) would represent the 50 states and the District of Columbia, each labeled clearly. The vertical axis (y-axis) would represent the number of disenrollments, using a consistent scale to allow for easy comparison. Each state would be represented by a bar, the height of which corresponds to its total number of disenrollments.

For example, a state with a high number of disenrollments would have a tall bar, while a state with fewer disenrollments would have a shorter bar. Color-coding could be used to highlight states with exceptionally high or low disenrollment rates compared to the national average, providing immediate visual cues for significant variations. The chart title would clearly state “Medicaid Disenrollments by State,” and a legend would explain the color-coding scheme if used.

The data points would be sourced from the KFF report on Medicaid redeterminations, ensuring accuracy and transparency. This visualization would quickly reveal which states experienced the most significant impacts from the redetermination process.

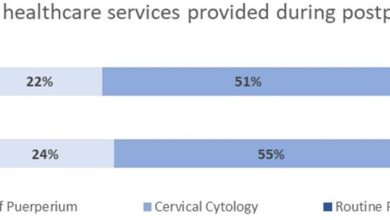

Demographic Breakdown of Disenrolled Individuals

A pie chart would effectively illustrate the demographic breakdown of those disenrolled from Medicaid. The entire pie represents the total number of disenrollments. Each slice of the pie would represent a specific demographic group, such as age group (e.g., 18-24, 25-34, etc.), race/ethnicity (e.g., White, Black, Hispanic, Asian, etc.), or gender. The size of each slice would be proportional to the percentage of disenrollments within that demographic group.

For example, a large slice would indicate a significant percentage of disenrollments within that demographic category. The chart would include a legend clearly identifying each slice and its corresponding percentage. The title would be “Demographic Breakdown of Medicaid Disenrollments.” This visualization would provide immediate insight into which demographic groups were disproportionately affected by the redeterminations, potentially highlighting disparities in access to healthcare.

Again, data would be sourced from the KFF report.

Wrap-Up

The KFF report’s findings on over half a million Medicaid disenrollments serve as a wake-up call. The sheer scale of this issue underscores the urgent need for systemic reform within the Medicaid system. Addressing administrative barriers, improving outreach efforts, and implementing policies that prioritize health equity are not just important, they are essential to ensuring everyone has access to the healthcare they need.

This isn’t just about numbers; it’s about people, families, and communities. The conversation must continue.

Key Questions Answered

What exactly are Medicaid redeterminations?

Medicaid redeterminations are the periodic reviews conducted to verify that individuals still meet the eligibility requirements for Medicaid coverage. These reviews ensure that the program’s resources are allocated efficiently.

Why are so many people losing their Medicaid coverage?

Several factors contribute, including complex application processes, bureaucratic hurdles, changes in income or family status, and a lack of awareness about the redetermination process. Many individuals may struggle to navigate the required paperwork or may not receive adequate support throughout the process.

What are the long-term consequences of losing Medicaid coverage?

Losing Medicaid can lead to delayed or forgone medical care, worsening health conditions, increased medical debt, and financial hardship. It can also negatively impact mental health and overall well-being.

What can be done to improve the Medicaid redetermination process?

Potential solutions include simplifying the application process, improving outreach and communication, providing more support to those navigating the system, and strengthening eligibility criteria to ensure that those who truly need Medicaid are not disenrolled.