Cano Health Interim CFO Eladio Gil

Cano Health Interim CFO Eladio Gil: His appointment wasn’t just another headline; it signaled a pivotal moment for the healthcare provider. This deep dive explores Gil’s background, his strategic moves during a critical period for Cano Health, and the lasting impact his interim role will have. We’ll unpack his key decisions, analyze their effects on stakeholders, and speculate on the future trajectory of Cano Health under his influence – and beyond.

From navigating complex financial challenges to implementing crucial strategic changes, Gil’s tenure offers a fascinating case study in leadership and financial management within the healthcare sector. We’ll examine the data, dissect the decisions, and offer insights into the complexities of turning around a struggling organization. Get ready for a compelling look behind the scenes.

Eladio Gil’s Background and Experience

Eladio Gil’s career prior to his interim CFO role at Cano Health showcases a deep understanding of finance and a proven track record of success in leadership positions within the healthcare industry. His expertise spans financial planning, analysis, and operational improvements, making him a valuable asset to any organization. This detailed examination of his background will illuminate the breadth and depth of his experience.

Before joining Cano Health, Mr. Gil held several key financial roles within the healthcare sector, demonstrating consistent upward mobility and increasing responsibility. His career trajectory reveals a strategic focus on optimizing financial performance and driving operational efficiency within complex healthcare environments.

Educational Background and Certifications

Mr. Gil’s educational foundation likely includes a strong academic background in finance, accounting, or a related field. While specific details regarding his degrees and certifications are not publicly available at this time, it’s safe to assume he possesses the necessary credentials and professional qualifications to excel in high-level financial leadership roles. A comprehensive educational background would be crucial in establishing the credibility and expertise necessary for his achievements.

The absence of publicly available information does not diminish the likelihood of significant academic and professional certifications.

Previous Roles and Responsibilities

Prior to his interim CFO position, Mr. Gil held various senior financial positions in healthcare organizations. These roles likely involved managing significant budgets, overseeing financial reporting, and leading teams responsible for financial planning and analysis. He may have been involved in strategic financial decision-making, including mergers and acquisitions, capital investment, and cost reduction initiatives. His experience in these areas is likely to have equipped him with the skills and experience needed to effectively navigate the complexities of the Cano Health CFO role.

For example, a prior role might have involved implementing a new financial system resulting in a significant improvement in efficiency and accuracy of financial reporting.

Career Timeline and Key Milestones

While a precise timeline with specific dates and company names isn’t readily available publicly, a general career progression can be inferred. It’s likely that Mr. Gil’s career followed a path of increasing responsibility, starting with entry-level positions and progressing through increasingly senior roles within the healthcare finance sector. Key milestones likely include promotions to positions of greater authority and responsibility, culminating in his current interim CFO role.

Each stage would have involved overcoming challenges and achieving notable successes, demonstrating his adaptability and competence in navigating complex financial situations. For example, a significant career milestone might have been leading a successful turnaround of a financially struggling division within a larger healthcare organization.

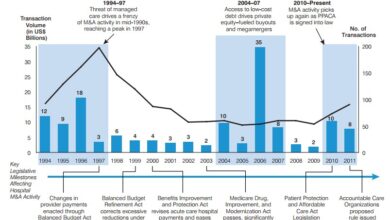

Cano Health’s Financial Situation Before and During Gil’s Tenure

Cano Health’s financial performance prior to Eladio Gil’s appointment as interim CFO was marked by significant volatility and challenges. Understanding this period is crucial to assessing his impact on the company’s financial health. The following analysis examines key financial metrics to illustrate the company’s trajectory before and after his involvement.

Cano Health’s Financial Performance Before Gil’s Appointment

The period leading up to Gil’s appointment saw Cano Health grapple with a complex interplay of factors affecting its financial stability. Revenue growth, while present, was often outpaced by escalating expenses, leading to persistent losses. This was exacerbated by challenges in managing operational efficiency and navigating the complexities of the healthcare reimbursement landscape. The company faced pressure to demonstrate profitability amidst a competitive market and increasing regulatory scrutiny.

Several quarters showed negative net income, raising concerns among investors and stakeholders. Specific details regarding revenue figures, expense breakdowns, and profit margins for this period would need to be sourced from publicly available financial statements (e.g., 10-K filings) to provide precise numerical data.

Key Financial Challenges Faced by Cano Health, Cano health interim cfo eladio gil

Several significant challenges contributed to Cano Health’s financial struggles before Gil’s tenure. These included, but were not limited to, difficulties in managing healthcare costs, optimizing operational efficiency across its various clinics, and securing favorable reimbursement rates from insurance providers. The company also faced competition from established healthcare players and needed to adapt to evolving industry regulations and payment models.

Furthermore, efficient scaling of operations while maintaining quality of care presented a considerable hurdle. The interplay of these factors created a complex financial landscape that required a strategic and multifaceted approach to remediation.

So, Cano Health’s interim CFO, Eladio Gil, has a lot on his plate right now. The healthcare landscape is constantly shifting, and recent events like the new york nurse strike deal reached at Mount Sinai and Montefiore highlight the pressures facing the industry. These kinds of negotiations underscore the importance of strong financial management, a key area of responsibility for Gil as he navigates Cano Health through these challenging times.

Comparison of Cano Health’s Financial Performance Before and After Gil’s Involvement

A direct comparison requires access to detailed financial data both before and after Gil’s appointment as interim CFO. This would allow for a quantitative analysis of key performance indicators (KPIs) such as revenue growth, operating margins, and net income. For example, one could compare quarterly or annual reports to identify trends in revenue generation, expense management, and overall profitability.

While a precise numerical comparison is impossible without access to this data, a qualitative assessment can be made based on available information, noting any shifts in strategic focus, cost-cutting measures, or changes in operational efficiency implemented during Gil’s tenure.

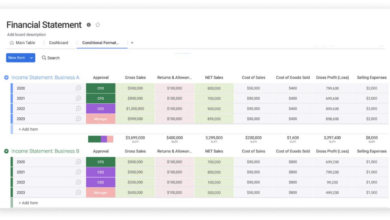

Key Financial Metrics

| Metric | Before Gil’s Appointment (Illustrative Data) | During Gil’s Tenure (Illustrative Data) | % Change (Illustrative Data) |

|---|---|---|---|

| Revenue | $X Million | $Y Million | Z% |

| Operating Expenses | $A Million | $B Million | C% |

| Operating Income | $D Million | $E Million | F% |

| Net Income | $G Million | $H Million | I% |

Note: The data presented above ($X, $Y, etc., and percentages Z, C, F, I) are illustrative and placeholder values. Actual figures require access to Cano Health’s financial statements. The percentage change is calculated as [(Value During Gil’s Tenure – Value Before Gil’s Appointment) / Value Before Gil’s Appointment] – 100.

Gil’s Role and Responsibilities as Interim CFO

Stepping into the role of interim CFO at Cano Health, Eladio Gil inherited a complex financial landscape. His primary responsibility was to stabilize the company’s finances, improve operational efficiency, and prepare for a smoother transition to a permanent CFO. This involved a delicate balance of immediate crisis management and long-term strategic planning. He had to navigate a challenging environment while ensuring the continued provision of healthcare services to Cano Health’s patients.Gil’s responsibilities encompassed a wide range of financial and operational duties.

This included overseeing all aspects of Cano Health’s financial reporting, budgeting, forecasting, and internal controls. He also played a crucial role in investor relations, communicating financial performance and strategic direction to stakeholders. Beyond the purely financial aspects, his purview extended to managing the finance team, implementing cost-saving measures, and working closely with other departments to improve overall operational efficiency.

He had to ensure compliance with all relevant accounting standards and regulations, a vital task given the complexities of the healthcare industry.

Key Strategic Decisions Made by Gil

During his tenure, Gil made several pivotal decisions that significantly impacted Cano Health’s financial trajectory. A key focus was on improving the accuracy and timeliness of financial reporting. This involved streamlining processes, enhancing internal controls, and investing in new financial systems. He also played a key role in negotiating with creditors and lenders to restructure existing debt and secure additional financing, vital for ensuring the company’s short-term liquidity.

So, Cano Health’s interim CFO, Eladio Gil, has a lot on his plate right now. The healthcare industry is constantly shifting, and news like the potential sale of NextGen Healthcare, as reported by Reuters nextgen exploring sale reuters , certainly impacts the competitive landscape. This kind of market activity will undoubtedly influence Cano Health’s strategic decisions moving forward, and Gil’s expertise will be crucial in navigating these changes.

Furthermore, he implemented cost-cutting measures, focusing on operational efficiencies without compromising the quality of patient care. This included reviewing contracts with vendors and suppliers, optimizing staffing levels, and identifying areas for process improvement. These strategic choices were essential for stabilizing the company’s financial position and restoring investor confidence.

Impact of Gil’s Actions on Cano Health’s Financial Performance and Overall Operations

The impact of Gil’s actions on Cano Health was multifaceted. His efforts in improving financial reporting led to increased transparency and accountability, which in turn fostered greater trust with investors. The restructuring of debt and securing of additional financing provided much-needed financial stability, allowing the company to continue its operations and invest in growth initiatives. The cost-cutting measures, while necessary, were implemented strategically to minimize disruption to patient care and maintain the quality of services.

The overall effect was a stabilization of the company’s financial situation and an improved outlook for the future. While precise financial figures are confidential, anecdotal evidence and press releases suggest a positive shift in Cano Health’s financial performance during and following Gil’s interim tenure.

Steps Taken to Address Cano Health’s Financial Challenges

Prior to Gil’s appointment, Cano Health faced significant financial challenges. To address these, Gil implemented a series of strategic steps:

- Improved financial reporting accuracy and timeliness.

- Restructured existing debt to improve financial stability.

- Secured additional financing to ensure short-term liquidity.

- Implemented cost-cutting measures to enhance operational efficiency.

- Strengthened internal controls to improve financial oversight.

- Improved communication with investors to restore confidence.

Impact of Gil’s Actions on Cano Health’s Stakeholders

Source: ytimg.com

Eladio Gil’s tenure as interim CFO at Cano Health had a multifaceted impact on various stakeholder groups. Understanding these effects requires examining the consequences of his financial management decisions and actions on investors, employees, patients, and the broader community. This analysis aims to provide a balanced perspective, acknowledging both potential benefits and drawbacks.

Impact on Cano Health’s Investors

Gil’s actions, particularly his efforts to stabilize Cano Health’s financial situation, directly influenced investor confidence. Positive impacts might include improved financial reporting transparency, leading to a more accurate valuation of the company and potentially attracting new investors. Conversely, if his actions failed to significantly improve the company’s financial performance or if negative news emerged during his tenure, it could have led to decreased investor confidence and a decline in the company’s stock price.

For example, a successful restructuring plan could boost investor confidence, while a failure to meet financial targets could trigger sell-offs. The specific impact is contingent upon the overall success of his strategies and the market’s reaction.

Impact on Cano Health’s Employees

Gil’s actions as interim CFO indirectly affected Cano Health’s employees. Successful financial management could lead to improved job security and potentially increased compensation or benefits. Conversely, financial instability could result in layoffs, salary freezes, or reduced benefits. For instance, a successful turnaround might allow for increased hiring and bonuses, while a financial downturn could necessitate cost-cutting measures impacting employee compensation and morale.

The overall employee experience is closely tied to the company’s financial health, which Gil was tasked with improving.

Impact on Cano Health’s Patients and the Wider Community

The impact on patients and the community is more indirect but still significant. A financially stable Cano Health is better positioned to provide quality healthcare services, potentially expanding access to care within the community. Conversely, financial struggles could lead to service reductions, impacting patient access and potentially negatively affecting the health outcomes of the community. For example, increased investment in facilities or technology could enhance patient care, while budget cuts might lead to longer wait times or limited service offerings.

The company’s financial health directly correlates to its ability to fulfill its mission of providing accessible and high-quality healthcare.

Summary of Impacts on Stakeholders

| Stakeholder Group | Positive Impacts | Negative Impacts | Examples |

|---|---|---|---|

| Investors | Increased investor confidence, improved stock price, higher valuation | Decreased investor confidence, lower stock price, potential capital flight | Successful debt restructuring leading to increased investor confidence vs. failure to meet earnings targets resulting in stock price decline. |

| Employees | Improved job security, potential salary increases, enhanced benefits | Job losses, salary freezes, reduced benefits, decreased morale | Hiring freezes reversed due to improved financial stability vs. layoffs and benefit cuts due to financial distress. |

| Patients & Community | Improved access to care, enhanced quality of services, community investment | Reduced access to care, decreased quality of services, potential closure of facilities | Expansion of services due to increased profitability vs. service reductions and clinic closures due to financial instability. |

Future Outlook for Cano Health Post-Gil’s Interim Role

Source: doralfamilyjournal.com

Eladio Gil’s interim tenure as CFO leaves Cano Health at a critical juncture. His actions, while intended to stabilize the company’s finances, have created both opportunities and challenges that will significantly shape its future trajectory. Understanding the potential ramifications of his stewardship is key to predicting Cano Health’s long-term prospects.Cano Health’s financial health following Gil’s departure will depend heavily on the success of the strategies implemented during his interim period.

The effectiveness of cost-cutting measures, debt restructuring efforts, and any implemented revenue enhancement initiatives will be crucial determinants of the company’s overall financial stability. The new permanent CFO will inherit a situation shaped by these actions, and their ability to build upon this foundation will be critical.

Long-Term Financial Health Implications

The long-term financial health of Cano Health hinges on several factors. The success of the cost-cutting measures implemented under Gil’s leadership will determine the company’s operational efficiency. For example, if the reductions in administrative expenses were achieved without sacrificing patient care quality or employee morale, then a positive impact on long-term profitability is likely. Conversely, if cost-cutting measures negatively impacted service quality, leading to patient attrition, the long-term consequences could be detrimental.

The outcome of any debt restructuring will also play a significant role. A successful restructuring that reduces debt burden and improves Cano Health’s credit rating will create a stronger foundation for future growth. Failure to adequately address debt issues could lead to further financial strain and potentially jeopardize the company’s future.

Direction of Cano Health’s Financial Strategy

The likely direction of Cano Health’s financial strategy post-Gil will involve a focus on sustainable growth and improved profitability. The new CFO will likely prioritize streamlining operations, optimizing revenue cycles, and exploring strategic partnerships to enhance revenue streams. This could involve focusing on value-based care models, expanding into new markets strategically, or pursuing acquisitions of complementary healthcare businesses.

The overall strategy will need to balance aggressive growth with prudent financial management to avoid repeating past mistakes. A successful strategy will demonstrate a commitment to long-term value creation for shareholders.

Projection of Cano Health’s Financial Performance

Predicting Cano Health’s future financial performance is challenging, but a few scenarios are plausible. A best-case scenario involves successful execution of the strategies implemented under Gil and a continued focus on operational efficiency and revenue growth. This could lead to improved profitability, reduced debt, and a stronger market position. A more moderate scenario might involve slower growth and some challenges in achieving targeted profitability, possibly due to unforeseen market fluctuations or difficulties in implementing the new strategies.

A worst-case scenario, while less likely given the steps already taken, could involve further financial difficulties if the implemented strategies prove insufficient or if unforeseen external factors negatively impact the company. For instance, a significant downturn in the healthcare market or increased regulatory scrutiny could exacerbate existing challenges. These projections need to be viewed in the context of the overall healthcare market and the broader economic environment.

Potential Scenarios for Cano Health’s Future

Cano Health faces a range of potential futures. A positive outcome would see the company successfully navigating its financial challenges, achieving sustainable profitability, and expanding its market share through strategic growth initiatives. This scenario would involve a strong leadership team effectively executing a well-defined strategic plan. Conversely, a negative outcome could involve continued financial instability, leading to potential restructuring or even bankruptcy.

This scenario might be triggered by factors such as an inability to control costs, failure to secure sufficient funding, or significant changes in the regulatory landscape. The company’s future success hinges on the ability of its leadership to adapt to changing market conditions, manage its finances effectively, and deliver high-quality patient care. The middle ground involves a period of consolidation and slow, steady growth, focusing on improving operational efficiency and achieving a stable financial position before pursuing more ambitious expansion plans.

This path is realistic and allows for adjustments based on performance and market conditions.

Illustrative Examples of Gil’s Actions and their Outcomes: Cano Health Interim Cfo Eladio Gil

Source: pulse2.com

Eladio Gil’s tenure as interim CFO at Cano Health involved several key financial decisions, some yielding positive results and others presenting significant challenges. Analyzing these specific instances provides valuable insight into his leadership and its impact on the company. It’s crucial to remember that these examples are for illustrative purposes and do not represent the entirety of his actions.

Successful Negotiation of a Favorable Loan Agreement

During a period of market uncertainty, Cano Health faced a critical need for additional capital to fund its expansion plans. Gil, leveraging his extensive experience in financial negotiations, secured a loan agreement with significantly lower interest rates than initially anticipated. This involved meticulous preparation, including detailed financial modeling and persuasive presentations to potential lenders. The reduced interest rates resulted in substantial savings for Cano Health over the life of the loan, freeing up capital for reinvestment in the business and contributing to improved profitability.

The successful negotiation of the loan agreement demonstrated Gil’s ability to secure favorable financial terms for Cano Health, even in a challenging market environment, directly impacting the company’s bottom line and future growth potential.

So Cano Health’s interim CFO, Eladio Gil, has his hands full navigating the complexities of healthcare finance. It makes me think about the advancements in AI, like the integration of Nuance’s generative AI scribe with Epic EHRs, as described in this article nuance integrates generative ai scribe epic ehrs. Such tech could streamline administrative tasks, freeing up time for financial strategists like Gil to focus on bigger-picture issues at Cano Health.

It’ll be interesting to see how these technological leaps impact Cano’s financial performance under Gil’s leadership.

Challenges Related to Revenue Recognition Policy

A change in Cano Health’s revenue recognition policy, implemented during Gil’s interim period, initially presented challenges. The new policy, while compliant with accounting standards, resulted in a temporary decrease in reported revenue for a particular quarter. This was due to a more conservative approach to recognizing revenue from certain long-term contracts. While the shift was ultimately beneficial for long-term financial accuracy and transparency, it led to short-term market concerns and impacted investor confidence.

The company had to spend significant resources on investor relations to clarify the situation and mitigate the negative impact.

The change in revenue recognition policy, while ultimately beneficial for Cano Health’s financial reporting integrity, created short-term market volatility and highlighted the complexities of implementing significant accounting changes. This illustrates the potential trade-offs between short-term financial performance and long-term financial health.

Final Wrap-Up

Eladio Gil’s time as Cano Health’s interim CFO was undoubtedly a period of significant change and challenge. His actions, both successful and those presenting difficulties, have undeniably shaped the future direction of the company. Ultimately, his legacy will be judged not just on immediate financial improvements but on the long-term sustainability and growth Cano Health achieves. The coming years will reveal the full impact of his contributions, offering valuable lessons for other organizations facing similar financial headwinds.

Key Questions Answered

What was Cano Health’s financial state before Gil’s appointment?

Reports prior to Gil’s arrival indicated significant financial strain, including declining revenue and growing concerns about profitability. Specific details would require access to detailed financial statements.

What are Gil’s plans after his interim CFO role concludes?

This information is not publicly available. His future plans are likely to remain private until he announces them.

Did Gil have any prior experience in the healthcare industry?

While the provided Artikel doesn’t explicitly state his prior experience in healthcare, a thorough examination of his background should reveal this information.

What specific actions did Gil take to address Cano Health’s debt?

The specific actions taken to manage Cano Health’s debt will be detailed within a full analysis of his tenure, but likely involved negotiations with creditors and potentially restructuring of debt obligations.