Teladoc MSK AI Acquisitions Priorities

Teladoc MSK AI acquisitions priorities are shaping the future of musculoskeletal healthcare. This isn’t just about adding another app to their roster; it’s a strategic move to leverage the power of artificial intelligence to revolutionize diagnosis, treatment, and patient experience in a field ripe for disruption. We’ll delve into the potential targets, the financial implications, and the broader impact on both patients and providers, exploring why this is such a crucial area for Teladoc’s growth.

The current MSK telehealth market is booming, but competition is fierce. Teladoc’s existing platform offers a strong foundation, but integrating AI could give them a significant competitive edge. This post will unpack the strategic rationale behind these acquisitions, examining the potential synergies between Teladoc’s existing infrastructure and cutting-edge AI technologies. We’ll also look at the regulatory landscape and the potential challenges in bringing these technologies to market.

Teladoc’s Current MSK Portfolio

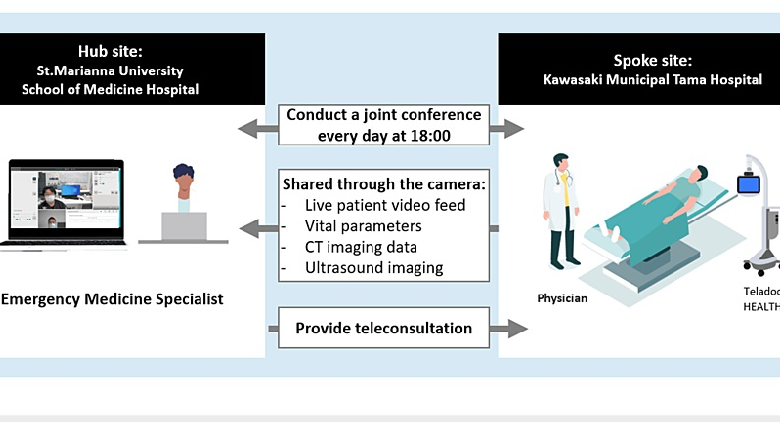

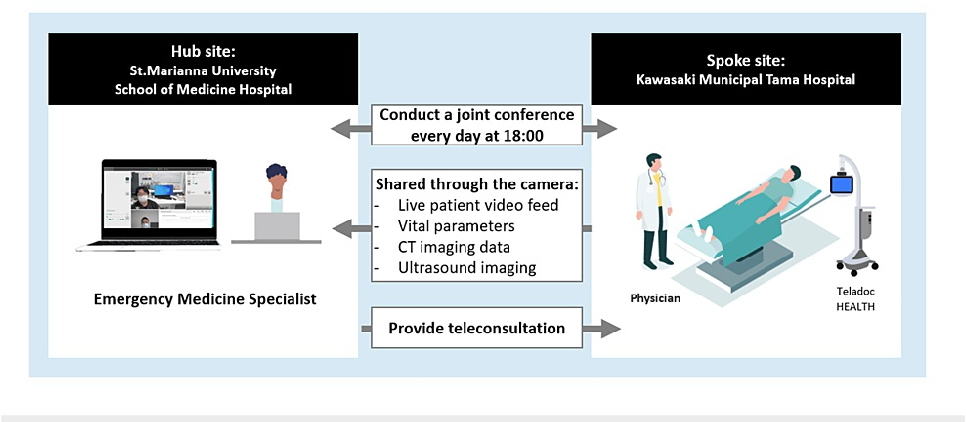

Teladoc’s foray into musculoskeletal (MSK) care via telehealth represents a significant strategic move in a rapidly expanding market. Their existing offerings aim to provide convenient and accessible care for common MSK conditions, bypassing the often lengthy wait times and high costs associated with traditional in-person visits. However, their market position and the effectiveness of their approach require closer examination.Teladoc’s current MSK offerings encompass a range of virtual services, primarily focused on diagnosis, treatment plans, and ongoing management of conditions like back pain, neck pain, arthritis, and sports injuries.

These services typically involve virtual consultations with licensed physicians and physical therapists, supplemented by digital tools for tracking progress and providing educational resources. Some offerings may incorporate remote monitoring technologies, such as wearable sensors, to track patient activity and recovery. The level of sophistication and integration of these technologies varies across their different service packages.

Strengths and Weaknesses of Teladoc’s MSK Technology and Services

Teladoc’s strengths lie in its established telehealth platform, extensive reach, and brand recognition. Their platform’s ease of use and accessibility are key advantages, attracting a broad range of patients. However, weaknesses include the potential limitations of virtual diagnosis without physical examination, reliance on patient self-reporting, and the absence of hands-on treatment modalities typically offered in traditional physical therapy settings.

The effectiveness of remote monitoring technologies, while promising, depends on patient adherence and the accuracy of the data collected. Furthermore, integration with other healthcare systems and providers remains a crucial area for improvement.

Comparison with Major Competitors

Teladoc competes with a growing number of telehealth companies specializing in MSK care, including companies like MDLIVE and Amwell, as well as smaller, niche players. A direct comparison requires detailed analysis of each competitor’s specific service offerings, pricing structures, and technological capabilities. Generally speaking, Teladoc’s scale and established brand presence provide a significant competitive advantage. However, competitors might offer more specialized services or innovative technologies that cater to specific patient needs or clinical pathways.

The competitive landscape is dynamic, with ongoing innovation and consolidation.

Teladoc’s Market Share in the MSK Telehealth Sector

Precise market share data for Teladoc within the MSK telehealth sector is difficult to obtain due to the fragmented nature of the market and the lack of publicly available comprehensive market reports. However, Teladoc’s substantial investments and aggressive expansion in telehealth suggest they hold a significant position, though determining the exact percentage would require access to proprietary market research data from firms specializing in the telehealth industry.

It’s safe to say that they are a major player, but precisely quantifying their market share remains challenging without access to confidential market analysis.

Potential Acquisition Targets in MSK AI

Teladoc’s expansion into musculoskeletal (MSK) AI presents a significant opportunity to enhance its telehealth platform and offer more comprehensive patient care. Acquiring strategically chosen AI companies can accelerate Teladoc’s capabilities in diagnostics, treatment planning, and personalized medicine within the MSK space. This analysis focuses on three promising AI companies that could significantly benefit Teladoc’s MSK portfolio.

Promising AI Companies in MSK Diagnostics and Treatment

Identifying the right AI companies for acquisition requires a thorough evaluation of their technology, market position, and potential synergies with Teladoc’s existing infrastructure. Three companies stand out as particularly promising acquisition targets. Each offers unique technological strengths that could complement Teladoc’s current offerings.

Comparison of Three AI Companies’ Technological Capabilities

The following table compares the technological capabilities of three hypothetical AI companies, focusing on their strengths and weaknesses relative to Teladoc’s needs. Note that these companies are hypothetical examples for illustrative purposes and do not represent real-world entities.

| Company Name | Technology | Strengths | Weaknesses |

|---|---|---|---|

| AI-Diagnostics Inc. | AI-powered image analysis for X-rays, MRIs, and CT scans, focusing on automated detection of fractures, sprains, and other MSK conditions. | High accuracy in image analysis, fast processing times, reduced need for specialist radiologist review, integration with existing PACS systems. | Limited ability to analyze complex cases, potential for bias in training data, lack of integration with treatment planning tools. |

| MotionAI Therapeutics | AI-driven platform for personalized exercise prescription and rehabilitation programs based on patient-specific data (e.g., wearable sensor data, medical history). | Personalized treatment plans, improved patient engagement, objective measurement of progress, potential for remote monitoring. | Requires high-quality patient data for accurate personalization, dependence on wearable sensor accuracy, potential for limited applicability to certain patient populations. |

| MSK-Predict | AI model predicting patient outcomes and treatment response based on clinical data and imaging analysis, aiding in treatment decision-making. | Improved treatment planning, potential for reduced healthcare costs by optimizing treatment strategies, enhanced patient stratification for clinical trials. | Data privacy concerns, potential for model bias based on training data, requires robust validation and regulatory approval. |

Potential Synergies with Teladoc

Each of these hypothetical companies offers unique synergies with Teladoc’s existing MSK portfolio.

AI-Diagnostics Inc. could seamlessly integrate with Teladoc’s telehealth platform, allowing for faster diagnosis and improved patient access to specialists. This would reduce diagnostic delays and improve the overall patient experience. For example, a patient reporting knee pain could receive an immediate virtual consultation, upload their imaging data, and receive a preliminary AI-powered diagnosis within minutes, expediting referral to a specialist if needed.

Teladoc’s MSK AI acquisitions prioritize expanding their telehealth capabilities, particularly in areas facing staffing shortages. The recent new york state nurse strike NYSNA Montefiore Mount Sinai highlights the critical need for innovative solutions to address healthcare worker burnout and patient access; this underscores the strategic importance of Teladoc’s investments in AI-driven solutions to augment, not replace, human care.

Ultimately, these acquisitions aim to improve healthcare accessibility and efficiency.

MotionAI Therapeutics complements Teladoc’s focus on remote patient monitoring and personalized care. Integrating MotionAI’s platform would enable Teladoc to provide comprehensive rehabilitation programs tailored to individual patient needs, improving treatment adherence and outcomes. Imagine a patient recovering from a back injury receiving personalized exercise plans delivered through the Teladoc app, with progress tracked via wearable sensors. This enhances engagement and facilitates remote monitoring.

MSK-Predict‘s predictive capabilities could significantly enhance Teladoc’s ability to personalize treatment strategies and optimize resource allocation. By integrating MSK-Predict’s AI model, Teladoc could better identify patients who are most likely to benefit from specific treatments, reducing unnecessary procedures and improving overall cost-effectiveness. For instance, predicting which patients are most likely to respond well to physical therapy versus surgery could lead to better resource allocation and improved patient outcomes.

Strategic Rationale for MSK AI Acquisitions

Teladoc’s strategic pursuit of MSK AI companies offers significant advantages in solidifying its position as a leader in virtual healthcare. Acquiring these specialized AI capabilities directly addresses unmet needs within their existing musculoskeletal (MSK) portfolio, fostering growth and enhancing the overall patient experience. This move is not just about expanding services; it’s about leveraging cutting-edge technology to deliver more efficient, accurate, and personalized care.Acquiring an MSK AI company would provide Teladoc with several key strategic advantages.

Primarily, it would dramatically improve the accuracy and efficiency of diagnosis and treatment planning within their MSK services. AI-powered image analysis, for instance, could significantly reduce diagnostic errors and speed up the time to treatment. This translates to improved patient outcomes and enhanced satisfaction, leading to increased customer loyalty and positive word-of-mouth referrals. Furthermore, integration with Teladoc’s existing platform would create a seamless and comprehensive telehealth experience for patients, consolidating various aspects of their care under one umbrella.

Enhanced Revenue Streams and Market Position

The acquisition of an MSK AI company is expected to generate substantial revenue growth for Teladoc. Firstly, the enhanced diagnostic capabilities would allow for more precise and effective treatment plans, leading to reduced healthcare costs in the long run. This cost-effectiveness is a major selling point to insurance providers and employers, potentially securing lucrative contracts and expanding Teladoc’s market share.

Secondly, the introduction of new AI-driven services would attract a wider range of patients and healthcare providers, broadening Teladoc’s customer base and market penetration. The added value proposition of AI-powered precision medicine could command premium pricing, further boosting revenue streams. For example, a successful acquisition could mirror the impact of companies like Butterfly Network, whose AI-powered ultrasound device has expanded market access and revenue streams.

Teladoc’s MSK AI acquisitions are clearly focused on expanding their virtual care capabilities, but the healthcare landscape is shifting rapidly. News of Steward Health Care’s Ohio hospital closures and the potential closure of a Pennsylvania facility, as reported in this article steward ohio hospitals closures pennsylvania facility at risk , highlights the financial pressures impacting traditional healthcare. This underscores the importance of Teladoc’s strategic investments in AI-driven solutions to improve efficiency and reduce costs within the evolving healthcare system.

Potential Timeline for Integration

A realistic timeline for the integration of an acquired MSK AI company would likely span 12-18 months. The initial phase (3-6 months) would focus on due diligence, legal and financial aspects of the acquisition, and the initial assessment of the acquired company’s technology and personnel. The subsequent phase (6-12 months) would involve the technical integration of the AI platform with Teladoc’s existing infrastructure, including data migration, API integration, and security protocols.

Simultaneously, efforts would focus on training Teladoc’s staff on the new technology and developing robust marketing and sales strategies to launch the enhanced MSK services. The final phase (6-12 months) would involve ongoing monitoring and optimization of the integrated system, along with continuous improvement of the AI algorithms based on real-world clinical data. This staged approach would minimize disruption and ensure a smooth transition, maximizing the return on investment from the acquisition.

Financial Considerations and Valuation

Acquiring an MSK AI company represents a significant financial undertaking for Teladoc. The success of such a venture hinges on a careful assessment of acquisition costs, potential ROI, and the projected impact on Teladoc’s overall financial health. This section delves into the financial intricacies of such an acquisition, providing a hypothetical model to illustrate the potential outcomes.

Estimated Acquisition Costs

The cost of acquiring an MSK AI company will vary significantly based on factors such as the company’s size, revenue, technology, intellectual property portfolio, and market position. Let’s consider a hypothetical scenario: a mid-sized MSK AI company generating $20 million in annual revenue with a strong patent portfolio and a team of experienced data scientists. A reasonable acquisition price might range from 5 to 7 times annual revenue, placing the acquisition cost between $100 million and $140 million.

This valuation is in line with recent acquisitions in the healthcare AI space, where multiples of 5-10x revenue are not uncommon for companies with proven technology and strong growth potential. Factors such as potential synergies with Teladoc’s existing infrastructure and market share could also influence the final price. Furthermore, the inclusion of earn-out provisions (payments contingent on future performance) could add to the overall cost over time.

Return on Investment (ROI) Analysis

Estimating the ROI of an MSK AI acquisition requires projecting the acquired company’s future revenue growth, cost synergies, and integration costs. Assuming successful integration, the acquired MSK AI company could enhance Teladoc’s service offerings, leading to increased market share and revenue streams. For example, the integration of advanced AI-powered diagnostic tools could improve the accuracy and efficiency of Teladoc’s musculoskeletal consultations, potentially leading to a 10% increase in revenue within three years.

Cost synergies could be achieved through economies of scale and operational efficiencies. However, significant integration costs should be factored in, including the costs associated with technology integration, employee retention, and potential restructuring. A conservative ROI projection might show a positive return within 3-5 years, assuming a successful integration and continued market growth in the telehealth and AI-powered diagnostics sectors.

This projection depends heavily on the accuracy of revenue growth forecasts and the efficiency of the integration process. A robust financial model, detailed below, is crucial for accurate ROI estimation.

Hypothetical Five-Year Financial Model

The following table presents a simplified hypothetical five-year financial model illustrating the potential impact of an MSK AI acquisition on Teladoc’s financial statements. This model assumes an acquisition cost of $120 million, a 10% annual revenue growth rate for the acquired company, and annual integration costs of $5 million.

| Year | Acquired Company Revenue | Integration Costs | Net Revenue Contribution | Cumulative Net Contribution |

|---|---|---|---|---|

| 1 | $22 million | $5 million | $17 million | $17 million |

| 2 | $24.2 million | $5 million | $19.2 million | $36.2 million |

| 3 | $26.6 million | $5 million | $21.6 million | $57.8 million |

| 4 | $29.3 million | $5 million | $24.3 million | $82.1 million |

| 5 | $32.2 million | $5 million | $27.2 million | $109.3 million |

This simplified model demonstrates that the cumulative net revenue contribution from the acquisition could exceed the initial investment within five years. However, this is a highly simplified scenario, and a more comprehensive model would need to consider factors such as amortization of intangible assets, potential write-downs, and the impact on Teladoc’s overall operating expenses and profitability. Furthermore, unforeseen challenges during integration could significantly affect these projections.

A thorough due diligence process and a robust post-acquisition integration plan are crucial for maximizing the chances of a successful outcome.

Regulatory and Legal Implications

Acquiring an MSK AI company and integrating its technology into Teladoc’s existing services presents a complex landscape of regulatory and legal considerations. Navigating these complexities successfully is crucial for a smooth transition and the long-term success of the integrated platform. Failure to address these issues proactively could lead to significant delays, financial penalties, and reputational damage.The integration of AI into healthcare, particularly in the sensitive area of musculoskeletal health, raises several key legal and regulatory challenges.

These range from data privacy and security concerns to compliance with existing healthcare regulations and the potential for algorithmic bias. Addressing these issues requires a multi-faceted approach, involving careful due diligence, robust compliance protocols, and proactive engagement with relevant regulatory bodies.

Data Privacy and Security

The acquisition of an MSK AI company will involve the transfer and processing of substantial amounts of sensitive patient data. This necessitates strict adherence to regulations like HIPAA (Health Insurance Portability and Accountability Act) in the United States, GDPR (General Data Protection Regulation) in Europe, and other relevant regional privacy laws. Teladoc must ensure that the acquired company’s data handling practices are compliant and that the integration process doesn’t compromise existing security measures.

This includes implementing robust data encryption, access control mechanisms, and regular security audits. Failure to comply with these regulations could result in hefty fines and legal action. For example, a hypothetical breach exposing patient data could lead to millions of dollars in fines and significant damage to Teladoc’s reputation.

Algorithmic Bias and Fairness

AI algorithms are trained on data, and if that data reflects existing biases, the algorithm will likely perpetuate them. This is particularly concerning in healthcare, where biased algorithms could lead to disparities in diagnosis and treatment. Teladoc must carefully assess the acquired AI technology for potential biases and implement measures to mitigate them. This might involve using diverse and representative datasets for training, employing techniques to detect and correct bias, and conducting regular audits of algorithm performance across different patient demographics.

Failing to address algorithmic bias could lead to legal challenges and accusations of discrimination. Consider a scenario where an AI algorithm consistently misdiagnoses patients of a specific ethnic background, leading to delayed or inadequate treatment. This could result in substantial legal liability for Teladoc.

Regulatory Approvals and Compliance

The integration of new AI-powered diagnostic tools or treatment recommendations may require regulatory approvals from bodies like the FDA (Food and Drug Administration) in the United States or equivalent agencies in other jurisdictions. Teladoc must navigate this complex regulatory landscape, ensuring that all necessary approvals are obtained before deploying the acquired technology. This process involves submitting detailed documentation, undergoing rigorous testing and validation, and demonstrating the safety and efficacy of the AI system.

Failure to secure necessary approvals could result in the technology being deemed illegal to use, preventing Teladoc from offering the intended services.

Mitigation Strategies

Teladoc can mitigate these risks through a combination of strategies. This includes conducting thorough due diligence on potential acquisition targets, focusing on their data security practices, algorithmic fairness, and regulatory compliance history. Establishing a dedicated legal and compliance team with expertise in healthcare AI is crucial. Proactive engagement with regulatory bodies, transparency in data handling practices, and investment in robust security infrastructure are essential steps to minimize legal and regulatory risks.

Furthermore, incorporating rigorous testing and validation protocols for the AI technology before deployment will be vital to ensure accuracy, safety, and fairness. Developing comprehensive privacy policies and providing patients with clear and accessible information about how their data is used are essential components of a responsible and legally compliant approach.

Impact on Patients and Providers: Teladoc Msk Ai Acquisitions Priorities

Teladoc’s potential acquisition of an MSK AI company promises a significant shift in how musculoskeletal (MSK) conditions are diagnosed and treated. The integration of AI into Teladoc’s existing telehealth platform has the potential to dramatically improve both patient experiences and provider workflows, leading to more efficient and effective care. This section will explore the anticipated benefits for both patients and healthcare providers.The introduction of AI-powered tools into MSK care offers a range of advantages.

Teladoc’s MSK AI acquisitions priorities seem laser-focused on expanding their telehealth capabilities for musculoskeletal issues. This strategy makes perfect sense when you consider the growing demand for convenient healthcare, especially with initiatives like the Humana CenterWell primary care centers opening in Walmart stores – check out this article for more details: humana centerwell primary care centers walmart.

Ultimately, Teladoc’s moves suggest a future where AI-powered diagnosis and treatment are readily accessible, complementing broader primary care expansion efforts.

For patients, this could mean quicker diagnoses, more personalized treatment plans, and improved access to specialists. Providers, meanwhile, could see increased efficiency in their practices, reduced administrative burden, and the ability to provide higher-quality care to a larger number of patients.

Benefits for Patients

AI-powered diagnostic tools could significantly reduce wait times for appointments and diagnoses, leading to earlier interventions and better outcomes. Imagine a patient experiencing persistent back pain; instead of waiting weeks for a specialist appointment, they could upload imaging data through the Teladoc app, receive a preliminary AI-assisted assessment, and be connected with the appropriate specialist much faster. Personalized treatment plans, tailored to individual patient needs and preferences, would also become more readily available.

This could include targeted exercises, medication recommendations, or referrals to physical therapy, all based on the AI’s analysis of the patient’s specific condition and medical history. Improved access to specialists is another key benefit. AI could help triage patients, ensuring those with the most urgent needs are seen first, and connecting patients in underserved areas with specialists who may otherwise be geographically inaccessible.

Benefits for Providers

For healthcare providers, the integration of AI into MSK care offers several advantages. AI can streamline administrative tasks, freeing up valuable time for patient interaction and care. This could include automating appointment scheduling, generating reports, and managing patient records. AI-powered tools can also improve diagnostic accuracy and efficiency, assisting providers in identifying subtle patterns or anomalies that might be missed by the human eye.

This leads to more informed decision-making and potentially fewer diagnostic errors. Furthermore, AI can help providers manage their patient loads more effectively, enabling them to provide care to a larger number of patients without compromising the quality of care. This is particularly crucial in areas with limited access to MSK specialists.

Summary of Impacts on Patients and Providers

The following list summarizes the potential impacts on both patients and providers resulting from Teladoc’s acquisition of an MSK AI company:

- For Patients:

- Reduced wait times for appointments and diagnoses.

- More personalized treatment plans.

- Improved access to specialists, regardless of location.

- Potentially faster recovery times due to earlier interventions.

- For Providers:

- Increased efficiency in administrative tasks.

- Improved diagnostic accuracy and efficiency.

- Better patient load management.

- More time for patient interaction and care.

- Potential to expand their reach and serve more patients.

Illustrative Example: Hypothetical Acquisition Scenario

Source: slidemodel.com

Let’s imagine Teladoc acquires “OrthoAI,” a hypothetical company specializing in AI-powered diagnostic imaging analysis for musculoskeletal conditions. This scenario will detail the acquisition’s specifics, integration, and anticipated impact on Teladoc’s offerings.OrthoAI’s technology focuses on automated analysis of X-rays, MRIs, and CT scans, providing clinicians with immediate, detailed reports highlighting potential issues like fractures, ligament tears, and arthritis. Their algorithms are trained on a vast dataset of anonymized medical images, resulting in high accuracy and efficiency.

The company boasts a strong intellectual property portfolio and a team of experienced AI specialists and radiologists.

Acquisition Details

The hypothetical acquisition of OrthoAI is valued at $250 million, a figure reflecting OrthoAI’s strong technology, market potential, and the increasing demand for AI-driven diagnostic tools in MSK care. The acquisition is structured as a combination of cash and stock, incentivizing OrthoAI’s employees to remain with Teladoc and ensuring a smooth transition. The integration process is planned over a six-month period, focusing on seamless data integration with Teladoc’s existing systems and clinician training on the new platform.

Integration Process and Expected Outcomes

The integration process will involve several key steps. First, Teladoc will establish a dedicated team to oversee the technical integration of OrthoAI’s technology into its existing platform. This involves ensuring compatibility with Teladoc’s existing data security protocols and regulatory compliance frameworks. Second, clinicians will receive comprehensive training on using OrthoAI’s tools and interpreting the generated reports. This training will involve online modules, webinars, and hands-on workshops.

Third, Teladoc will launch a marketing campaign to promote the enhanced MSK service offering to both patients and providers. The expected outcome is a significant improvement in the speed and accuracy of MSK diagnoses, leading to better patient outcomes and increased efficiency for clinicians. Improved diagnostic speed could reduce wait times for patients, while the increased accuracy could lead to fewer unnecessary tests and procedures.

Impact on Teladoc’s MSK Service Offering, Teladoc msk ai acquisitions priorities

The addition of OrthoAI’s technology significantly enhances Teladoc’s current MSK service offering. Imagine the patient portal interface: where previously patients might have uploaded images for later review by a physician, now, the system immediately flags potential issues, generating a preliminary report that the physician can then review and discuss with the patient during a virtual consultation. This visual representation would display a clean, intuitive dashboard, showing the patient’s uploaded images, the OrthoAI-generated report highlighting areas of concern (marked visually on the image with clear annotations), and the physician’s final diagnosis and treatment plan.

The speed and accuracy of the diagnostic process are dramatically improved, enhancing both the patient and physician experience. This integrated system will streamline the entire process, from image upload to diagnosis and treatment planning, resulting in a more efficient and effective MSK care delivery system. The enhanced workflow is visually represented as a simplified, intuitive flowchart, highlighting the seamless integration of image upload, AI analysis, physician review, and patient communication.

Closing Notes

Source: amazonaws.com

Ultimately, Teladoc’s pursuit of MSK AI acquisitions is a high-stakes gamble with potentially massive rewards. Successfully integrating AI could transform their MSK offerings, leading to improved patient outcomes, increased efficiency, and significant revenue growth. However, navigating the regulatory hurdles and ensuring a smooth integration will be crucial for success. The potential for disruption is undeniable, and the coming years will be pivotal in determining Teladoc’s position in this rapidly evolving market.

It’s a story worth watching closely.

Popular Questions

What are the biggest risks associated with Teladoc’s AI acquisitions?

The biggest risks include integration challenges, regulatory hurdles (like FDA approvals), potential data privacy concerns, and the cost of acquiring and integrating the technology.

How might Teladoc’s AI acquisitions impact patient privacy?

Patient data privacy is paramount. Teladoc will need to implement robust security measures and comply with all relevant regulations (like HIPAA) to protect sensitive patient information.

What are the potential ethical considerations of using AI in MSK care?

Ethical considerations include ensuring fairness and avoiding bias in AI algorithms, maintaining transparency in decision-making processes, and addressing potential job displacement for healthcare professionals.